Problems In Europe Will Keep A Lid On the Market. Positive Action Through FOMC Next Week

Yesterday, the market tanked on European concerns and a dismal Unemployment Report. Bad news surrounded the market and investors sold stocks. The S&P 500 was down 30 points and the low was established early in the day. By mid-morning, bargain hunters started to nibble and the losses were almost erased by the end of the day. That reversal set a positive tone this morning and stocks are rebounding.

Overnight, German courts determined that the EFSF was constitutional. The court also decided that Germany's parliament needs to have a bigger voice in future decisions. This outcome was largely expected and this is simply a relief rally.

Greece will still miss its deficit targets, Italy is backing away from some of its austerity measures, Spain believes it will need bailout money, Finland wants collateralized loans before it makes new commitments, Slovakia won't vote on new EFSF funding until December (unanimous EU vote required) and only 7 out of 28 European banks would pass Basel III requirements. The problems run very deep and European credit concerns will keep constant pressure on the market.

Tomorrow, President Obama will deliver his "jobs plan". We can expect an extension in unemployment benefits and payroll tax credits. There should be tax credits for new hires and corporations might be able to bring back overseas profits at a favorable tax rate. These proposals are not new, but they should be "market friendly".

Analysts believe that this plan will not get through Congress unless immediate spending cuts offset the cost. A long-term infrastructure build out is out of the question. President Obama will leave the tough part out of his speech, but he will outline the program funding ($300B) next week. I believe it will include a corporate flat tax so that loopholes are closed. His popularity rating has hit new lows (40%) and he needs to "pull a rabbit out of his hat".

Next week, the FOMC will convene. The meeting has been extended from one day to two days. That has analysts believing that a new plan will be revealed. Rumor has it "Operation Twist" will purchase long-term debt and sell short-term debt. This process will add liquidity and no new money will be printed. From my perspective, this won't make any difference. Liquidity is not the problem. Regardless, the notion that the Fed will do something is bullish.

The economic news this week is fairly light. Yesterday, ISM services came in much better than expected and that partially fueled the reversal. The Beige Book will be released this afternoon and it should be a non-event. Regional data has been weak and if anything it will have a slightly bearish bias. Initial claims will be released tomorrow and anything above 410,000 would be problematic.

The ECB will release a statement tomorrow and the market is expecting the "hawkish" rhetoric to end. No one is expecting a rate cut anytime soon. Tomorrow night, China will release its CPI. Analysts are expecting it to drop slightly. If it does not, another rate hike could be coming soon.

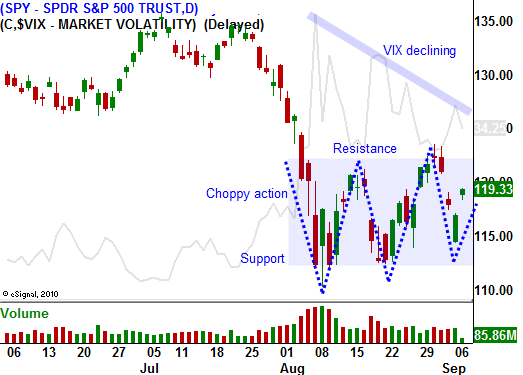

I still believe the market will test the downside one or two more times in September. However, with each passing week, the bid will strengthen. Asset Managers will start buying stocks in hopes of a year-end rally. This is the third year of a Presidential term and that has typically been bullish because the incumbent reaches across the aisle. I don't see that happening this year.

There is too much bad blood and politicians are polarized. Perry (conservative) is now leading in Republican polls and voters will be fragmented in 2012.

A huge rally started last September, but conditions are much different this year. Europe is clueless and the credit crisis has spread to major nations. Economic conditions around the globe are softening and they will continue to deteriorate as austerity programs are implemented. The "Super Committee" still has to trim $1.5 trillion from the budget by the end of November and tough decisions lie ahead.

From a trading standpoint, I was able to hang on to my put credit spreads. The market reversed yesterday and today's rally has me in great shape with only a week and a half left. I won't be adding to positions in this volatile environment. The price action should be positive into next Wednesday's FOMC announcement, but then all of the good news will be out and we will be ready for another decline.

On any decent sell-off to SPY 112, I will sell October put spreads. As I mentioned yesterday, any rally will be tenuous. Option implied volatilities are high and selling out of the money spreads is the way to go. There is bad news everywhere and you have to distance yourself form the action or be very nimble.

Daily Bulletin Continues...