Greece Should Get Funding and Central Banks Provide Dollar Liquidity To Euro Banks. Rally Tenuous

This week, the market rallied on the notion that Greece would get its next bailout payment. It will run out of money by the end of the month and this was a critical moment.

Conditions were rather tenuous heading into the week. Greece will substantially miss its budget targets and in dramatic fashion, it levied a personal income tax in the final hour. Citizens who refuse to pay will have their electricity turned off. This action got it closer to its targets ahead of a major meeting.

The ECB/IMF/EU (troika) met in Greece yesterday. Indications are that they will get their next tranche. This temporarily eases credit concerns, but the problems run very deep in Europe.

Banks have not been able to issue short-term debt and there was a liquidity problem. Financial institutions were reducing exposure and $50 billion worth of short-term debt was not rolled over. This morning, Central Banks announced that they will provide three month dollar loans. That will get European banks through the end of the year. The market rallied on the news, but it raises serious concerns. Perhaps the situation was getting dire and immediate action needed to be taken.

Yesterday, Moody's downgraded several French banks. This move was largely expected and the downgrades were not as widespread as expected. If Basel III were enacted, 21 out of 28 European banks would not pass reserve requirements.

Moody's started evaluating Italy's sovereign debt three months ago and analysts are waiting for the decision. It typically comes 2 to 3 months after the evaluation process begins and the news should be forthcoming in the next week. A downgrade would put Italy on the front burner.

Interest rates in Spain and Italy have started to rise. This is a warning sign and the EU is asking emerging markets (BRIC) to support bond auctions. India and Brazil are open to the idea, but China said that it will not formally commit until it sees fiscal responsibility.

The economic news was not good this morning. Initial jobless claims rose to 428,000 (well ahead of estimates). The trend has been higher and that does not bode well for September's Unemployment Report. Corporations "circled the wagons" during the debt ceiling debacle and I believe that restraint will result in an employment dip. Furthermore, the CPI rose .4% and Philly Fed declined by 17.5. Yesterday's Empire Manufacturing number was also weaker than expected.

The economic news is fairly light next week. The FOMC statement on Wednesday will be the major event. The Fed extended the meeting from one day to two days and that has traders believing that action will be taken. This sentiment will keep a small bid to the market; however, once the news passes the market will come under pressure. In reality, the Fed is "out of bullets" and QE2 did little to stimulate the economy.

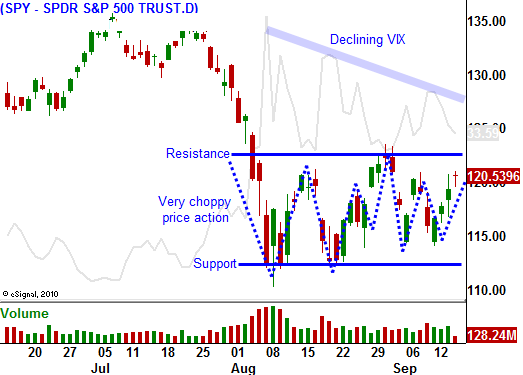

Stocks are stuck in a range and they are trading wildly from one extreme to the other. I believe this pattern will continue. Valuations are cheap, but credit concerns and deteriorating economic conditions will limit future rallies. As stocks drop down to the bottom of the range, Asset Managers will bargain hunt. They will try to buy stocks in anticipation of a year-end rally. The third-year of a presidential term is historically bullish. As stocks reach the top of their range, credit concerns will induce profit-taking.

I believe the next decline will present a decent buying opportunity. Earnings season is a month away and if warnings are minimal, stocks will rally. This pattern has been in place for more than eight consecutive quarters. Once we get past the first three weeks of earnings, stocks will come under pressure. Guidance will be cautious and that timeline coincides with the "Super Committee’s" deficit reduction plan. If they hit a roadblock, the market will decline.

On that note, Democrats did not want the debt ceiling to be an issue before 2012 elections. Soft economic growth (GDP at 1%) will reduce revenues and Obama's $450 "jobs plan" could push us to the debt ceiling before November. Economists and analysts believe that this stimulus will create 150,000 new jobs at most. From a purely political perspective, Republicans should pass the plan. If they do, Obama will not be able to point fingers and he will have to go through the debt ceiling process again.

I have been successfully selling out of the money put spreads. This strategy allows me to distance myself from the action and it takes advantage of high option premiums. Stock selection is critical and that’s where the Daily Report comes in. Focus on bullish stocks that are rising to the top of the Live Update table. Sell the spreads below major technical support and let time take care of the rest. You will not have to sweat these volatile moves and this strategy will yield excellent profits.

Conditions in Europe will only worsen from this point forward and volatility is here to stay. Use this trading pattern to your advantage.

Daily Bulletin Continues...