The Market Will Tread Water Through FOMC. Weakness After That.

This week the market rallied on the notion that Greece would secure financing. In dramatic fashion it levied a personal income tax so that it could get closer to hitting its budget targets. It seems that they will get the next tranche of money. This was critical for the market since Greece will run out of funds by the end of September.

The Euro credit problems still run deep and conditions could deteriorate at a moment's notice. French banks were downgraded this week and there is reluctance on the part of global banks to do business with European banks given the credit situation. Yesterday, Central Banks announced that they would provide dollar loans through the end of the year. Institutions have not rolled over $50 billion in short-term debt recently and the banks were getting desperate.

The market rallied on the news, but this action shows how fragile the situation is. Moody's started to evaluate Italy's finances three months ago and analysts believe that a decision could be released in the next week. Interest rates in Italy have been creeping higher and this news would result in a spike.

The FOMC extended its meeting next week from one-day to two. That has traders believing that the Fed will take action. Stocks should hold up ahead of the news, but they are likely to decline once the plan is announced. QE2 was ineffective and the Fed is "out of bullets".

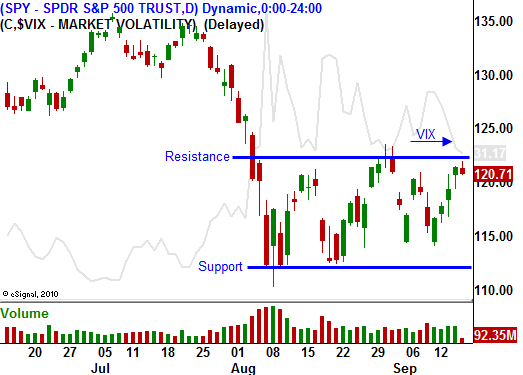

The market has been caught in a trading range and we are near resistance. Stocks are likely to pull back and that will present an excellent buying opportunity. Earnings season is approaching and the last eight quarters, stocks have moved higher into earnings season. Asset Managers will be anxious to get a jump on a year-end rally and they will buy dips. The third-year of a presidential term is historically bullish.

The economic news next week is fairly light. We should see a pullback during the next two weeks and it will be fueled by weak employment data and deteriorating economic conditions. The lower end of the trading range could be tested.

I have been selling out of the money put credit spreads this week and next week I will start selling out of the money call credit spreads. Option implied volatilities are high and I am playing the trading range.

It is hard to predict all of the wiggles and giggles with so many news events hitting the market on a daily basis. With that in mind, here is a recap of how I think things will play out in the next few weeks. The market will tread water into next week's FOMC statement. The initial reaction will be decent, but traders will question the effectiveness. In two weeks dismal economic data will push stocks lower. That will set up a buying opportunity just ahead of earnings season.

The bottom line is that volatility is here to stay. We will try to maintain our distance by selling the money credit spreads and we will play the range.

It is option expiration and you should expect choppy trading today.

Daily Bulletin Continues...