Market Acting Like the Fed Is Out of Bullets. FOMC On Wed Is the Main Event.

This morning the market is trading lower on credit crisis concerns in Europe. Conditions continue to deteriorate and this theme will dominate trading for months to come.

Greece is close to finalizing a deal that posts collateral for future loans. Finland said it will not extend bailouts unless guarantees or assets are used to back the loans. By the end of September, Greece will run out of money. Fortunately, they are likely to get the next tranche of funding.

Interest rates in Spain and Italy are creeping higher and credit concerns are spreading. European leaders are asking BRIC nations to buy European sovereign debt. They are open to the investments, but they want to see structural reform. Until entitlement programs are addressed the debt will continue to spiral out of control.

Domestically, President Obama wants to generate $1.5 trillion in tax revenues. He will ask Congress to eliminate the Bush tax credits. Republicans will reject this proposal unless massive entitlement reforms are included.

The economic news this week is fairly light. The FOMC will release its statement on Wednesday and many believe that they will introduce some type of stimulus. I thought the market would tread water ahead of the news, but investors feel that the Fed is simply going through the motions. Quantitative easing and little impact and all of the bullets have been fired.

Stocks are cheap. With every passing week, Asset Managers will get a little more aggressive. They will start buying stocks ahead of earnings season so that they can get a jump on the end of year rally.

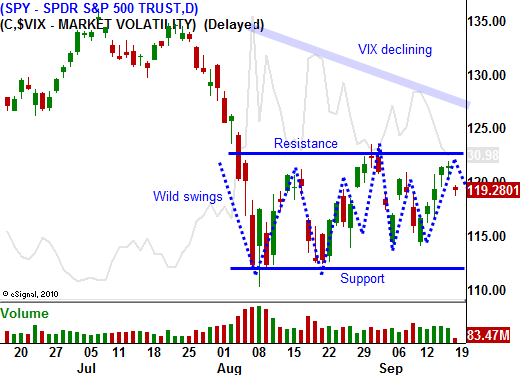

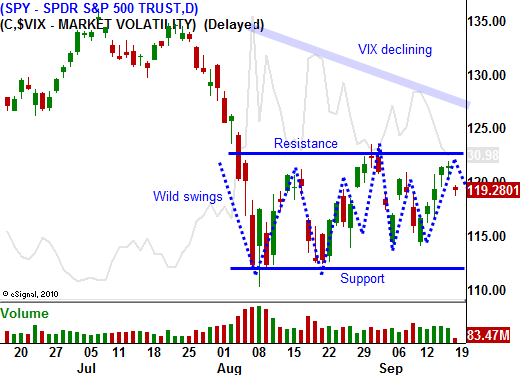

We are caught within a trading range and the market is moving wildly from one extreme to the other. This tug-of-war will continue for many months. On the one side we have attractive stock valuations and low interest rates. On the other side, we have a looming credit crisis and deteriorating economic conditions.

I welcome today's decline. As stocks retreat, I will be looking for put credit spread opportunities. Ideally, SPY 112 will be tested and it will hold. The Unemployment Report is still three weeks away (October 7). Initial claims continue to climb and that is a warning sign. I believe companies "clammed up" during the debt ceiling debacle and that nervousness will be seen in upcoming economic releases.

Stock valuations are so cheap that I am reluctant to sell out of the money call credit spreads. I was hoping for a nice rally into Wednesday so that I might be able to sell into strength. This morning's selloff has ruined that opportunity. I had a great September and my put spreads expired last week. This is a good time to keep your powder dry.

Wait for the market to reach one extreme or the other and sell out of the money options with the idea that stocks will return to the middle of the range. Implied volatilities are high and there is a nice edge to this strategy.

The tone has been set for the day and stocks have not moved much after the initial decline. We should finish right at this level.

Daily Bulletin Continues...