Damed If They Do – Damed If They Don’t. Selling After the FOMC Decision.

Yesterday, the market rallied ahead of today's FOMC statement. Traders believe that the Fed will announce some type of stimulus (Operation Twist). Overnight, there have been many opposing opinions.

Rumor has it that EU officials sent a letter to Ben Bernanke urging no new action by the Fed. They believe that this will only add to the problem and it won't create jobs. That same sentiment is being heard on "both sides of the aisle" in Washington. The Fed is "damned if they do and damned if they don't". The market expects action and it will decline if it doesn't get it.

As I mentioned yesterday, even if "Operation Twist" is implemented, it won't have much of an impact. The Fed tried it 40 years ago without any success. It's the effort that the market wants to see. Economic conditions are deteriorating and a lack of action would indicate that the Fed doesn't recognize the slowdown or that they feel helpless.

If the Fed takes action, the market will initially rally. That move will quickly run out of steam in the next few days and stocks will retreat. We will either see an immediate decline today if no action is taken or the market will rollover in coming days. Either way, we are faced with a "sell the news" situation.

Yesterday, Italy's debt was downgraded by Moody's. Interest rates spiked to a new 52-week high and that is a warning sign. Greece did not secure financing yet. The ECB/EU/IMF said there is more work to be done and they will meet again in 2 weeks. The decision is pending and the market will wait nervously. Most expect the funding to go through, but the uncertainty and the arduous process will weigh on the market.

Last week Moody's downgraded several French banks. If Basel III were enacted, only 7 out of 28 European banks would pass. Financial institutions have stopped trading with many Euro banks (Bank of China included) and that is the kiss of death. Before conditions worsened, Central Banks announced that they will provide ailing euro banks with dollar liquidity through the end of the year. Credit conditions are tenuous.

Basic materials have been crushed the last two days. Yesterday, JPM downgraded Molycorp because rare earth prices have declined. This morning, ANR and WLT lowered guidance because coal prices have dropped and shipments to China have been cancelled. Traders believe this is another sign that global economic conditions are slowing down.

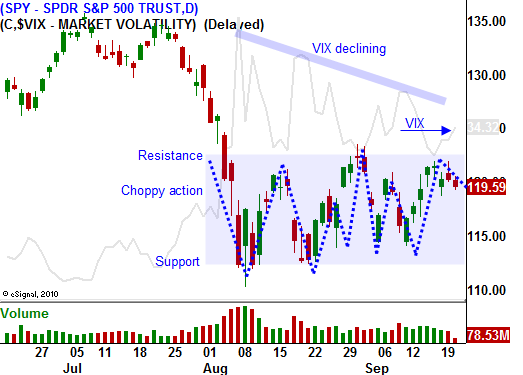

The market has reached the upper end of its trading range and we are likely to pullback. During the next two weeks, economic releases will be weak. Companies clammed up during the debt ceiling debacle and that softness will be seen in upcoming releases. Initial jobless claims have been climbing and that will weigh on the market tomorrow.

I bought a few puts yesterday and I am buying more today. I am going deep in the money so that I can side step rich implied volatilities. My positions are relatively small.

Once this wave of selling passes, I believe we will see a substantial rebound. It might only last a couple of weeks, but it will be strong. Greece will get its financing and Asset Managers will buy ahead of earnings season. The third year of a Presidential term has been historically bullish and they will be looking for a year-end rally.

Don't get your hopes up; this rally will not pack much of a punch. There are too many issues to work through and it will stall in November. We need to stay nimble and play the swings.

I suggest buying a few puts before the FOMC. If the market likes the stimulus, know that you can add to the position in a few days when the move runs out of steam. If the market does not like the statement, be ready to buy puts if the SPY makes a new low for the day.

I am short term bearish.

Daily Bulletin Continues...