Support Is Holding. The Market Will Stay At the Low End of the Range and Form A Base.

The European credit crisis continues to grow and officials are not grasping the gravity of the situation. Greece is likely to get the next payment, but that won't be finalized for two weeks. Analysts feel that it's just a matter of time until Greece defaults. The EU needs to circle the wagons and make sure that Spain and Italy have adequate financing.

Next week, EU member nations will vote on the EFSF. That process should go smoothly and it will calm nerves. With the enormous responsibility place on this facility, it is surprising that it only has 12 employees. Again, the EU doesn't realize how dire the situation is. They should quickly add staff so that future credit concerns can be addressed immediately.

Economic conditions are deteriorating globally. In the FOMC statement, the Fed sees substantial risk of an economic downturn. The flash PMI in Europe and China fell below 50 indicating contraction. Companies like MCP, WLT, FDX and CAVM are lowering guidance due to soft conditions.

Employment conditions are weak and initial jobless claims are creeping higher. Companies clammed up during the debt ceiling debate in August and that weakness is about to filter through the economy. Next week, durable goods, GDP, initial claims and Chicago PMI will be released. Bad news is priced in and the damage should be relatively contained. The Unemployment Report in two weeks will be dismal.

The good news is that stock valuations are cheap. I am having a difficult time finding sound shorts. The fundamentals are so good that stocks will rebound on the slightest signs of improvement.

Bullish speculators have been flushed out long ago and so have investors. Margin calls decrease with each subsequent retest of support and panic selling will subside.

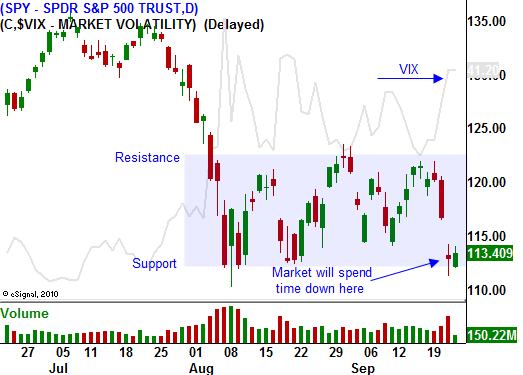

I believe the market will continue to test the downside the next two weeks. We will spend time forming a base in the lower end of the trading range. As earnings season approaches, the bid will strengthen. Asset Managers will look for bargains heading into year-end.

Option implied volatilities are high and I am getting ready to sell out of the money put credit spreads. I took profits on my put positions yesterday and I am flat heading into the weekend.

Start lining up strong stocks and get ready to sell puts below major support levels. The best candidates have weathered the selling this week and they are showing signs of life this morning.

Daily Bulletin Continues...