Europe Is Saying the Right Things and Ecomomic Condtions Are Improving. Rally Continues This Week

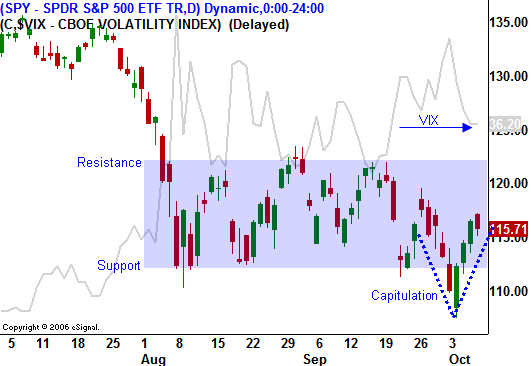

Last week the market staged an impressive rebound and it was able to hold the gains. Improving economic conditions trumped Euro credit concerns and Asset Managers bought stocks ahead of earnings season.

In the last two weeks, durable goods, Chicago PMI, ISM manufacturing, ISM services, GDP, initial claims, ADP Employment, retail sales and the Unemployment Report have all exceeded expectations. The soft patch created by the debt ceiling debacle in August has passed and pessimism was too high. China’s PMI was also better than expected and the global economy is not falling off a cliff.

Credit concerns in Europe have eased as well. Overnight, France and Germany said that they have a new plan to recapitalize banks and they are prepared to take action. The news out of Europe has been steady and as long as the market feels that the EU/ECB is not asleep at the wheel, the rally from last week will continue.

Earnings season begins after the close today. Stocks have rallied 8 straight quarters into earnings season and Asset Managers will be buying stocks ahead of the year end rally. They are rotating out of fixed income and into equities.

The momentum points higher and you should still be holding on to your calls. Overnight, global markets were strong and the S&P is poised to move higher this morning.

The earnings and economic news is fairly light this week. Shorts are nervous and they will get squeezed this week. We made it through the Unemployment Report and that was the wild card. Ride your long call positions for a few more days and take partial profits towards the end of the week.

The market will push higher out of the gate today and bears will test the downside. The gains will hold and the market will grind higher into the close.

.

.

.

Daily Bulletin Continues...