The Momentum Is Strong – No Road Bumps The Rest of the Week.

After a relatively quiet day yesterday, stocks are pushing higher this morning. The Shanghai index was up more than 3% and that is its biggest single day gain in more than a year. Traders suspect that the People’s Bank of China (PBOC) will ease.

Earnings season officially kicked off yesterday. Alcoa missed earnings estimates, but revenues were strong. It remains optimistic on growth in China.

The grand bailout plan in Europe is soothing credit concerns. The announcement won't come for another two weeks. This plan should include larger Greek haircuts, bank recapitalizations and a leverage component that will allow the EFSF to expand sovereign bond purchases. France and Germany are taking the lead role in this effort.

Slovakia did not pass the vote to expand the EFSF. However, a second vote will be held tonight and it is expected to pass. This is the only remaining country that has to approve the expansion. Even if they don't, a contingency plan is in place.

The Senate passed FX legislation last night and that was largely expected. The House will shoot it down today and it will not become law.

President Obama's jobs package did not pass as expected. It will be broken into pieces so that issues can be addressed one-by-one.

There are many small news items pending, but European credit concerns are of primary interest. Those seas will be calm for another week and the market should be able to move higher. Stock valuations are cheap and the strongest companies will be announcing over the next 10 days.

Bank stocks have been badly beaten down and they could rebound in the next week. J.P. Morgan will announce tomorrow and it is one of the strongest stocks in the sector. If financials gain traction, they will propel the entire market.

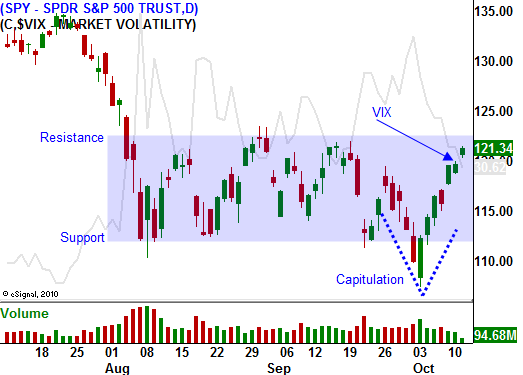

Yesterday I encouraged you to take partial profits on your positions. We've had a great run and I am expecting positive price action the rest of the week. The SPY is close to reaching $123. That is the first resistance level. If it breaks out, it could run to 125. I believe that will be a very strong resistance level.

In order for the market to break through that level, Europe's bailout plan will need to be very comprehensive. I doubt that will happen. They have been very casual about the whole credit situation and there are too many opposing opinions. Furthermore, who is going to finance the bailout?

I suggest riding profits on remaining positions for another week. If we get to SPY 125, get out. I like the price action today and the momentum should continue into the close. The news is fairly light this week and I don't see any “road bumps".

Daily Bulletin Continues...