Stocks Should Be Strong Into Wed On The Back Of IBM and INTC.

The market momentum is strong and stocks are pushing higher this morning. Tech earnings have been decent (INFY, ASML and GOOG) and that is putting a bid under the market. The only good news in the last six months has been earnings and we should see positive price action for another week.

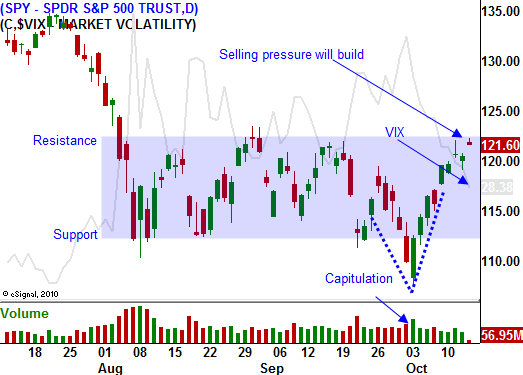

The major releases will begin Monday. IBM and Intel will report. Yesterday, J.P. Morgan said that PC sales in the third quarter exceeded estimates. Earnings should be strong and the market will test resistance at SPY 123 and 125.

The economic news has been fairly light. Last night, China's CPI was in line. That's good sign since it will reduce the need for monetary tightening. China's trade surplus came in a little lighter than expected, but it was not a major decline.

European credit concerns have temporarily eased. The market is expecting a comprehensive plan to capitalize banks and prevent contagion. Many European banks are considering the sale of assets to generate funds. They believe the cost of capital will be too high and this is a better alternative.

Europe is reaching out to emerging markets. They feel that required capital is greater than the amount Europe can raise. China and the US are also expected to participate in future bond auctions.

Once the first few weeks of earnings season passes, the focus will return to the European credit crisis and stagnant global economic growth. This rally could test the upper end of the range, but I do not believe we will break out.

Europe has been dragging its feet throughout the entire bailout process. There are too many "cooks in the kitchen" and they can't agree on anything. The plan will be half-baked and the financing will be a problem.

Our economy is not falling off a cliff, but it is not growing either. The "Super Committee" will be releasing its plan in a few weeks. The cuts are not impacting current conditions, but they will provide a stiff head wind in the future.

We are in the sweet spot right now. Enjoy the ride and hang on to your remaining call positions. This rally might have another 3% of upside, but those gains will be hard fought. Trim your size and take profits.

In two or three weeks we will get a tradable pullback. The easy money has been made and I urge you not to give it back. Conditions are still very tenuous and bad news lurks around every corner.

I was hoping for a pullback this week, but we didn't get one. If stocks would have declined, I would have bought that dip. We are likely to rally through Wednesday on the back of Intel's earnings.

The price action looks good today, but the upside should be relatively contained since we are bumping up against first resistance at SPY 123. The gains should hold, but I do not believe we will advance much beyond SPY 122.50 today.

Daily Bulletin Continues...