The Market Is Not Rallying On A Solution – It Is Rallying On Hope. We Could See A Failed Breakout

I mentioned yesterday that this is a very dangerous market to trade. Monday, the market was down big, Tuesday it rebounded. Wednesday the market was down big, Thursday it rebounded. The market is filled with “noise”, but there was a very critical moment yesterday that caught my attention.

All of the news out of Europe was very negative and the market had every reason to sell off Thursday. In line with comments I made, I bought puts when the SPY traded below 120.80. That was a good entry point and I felt the selling momentum would build throughout the day. Stocks caught a bid and they gradually started to recover. I had my stop in place and I took a loss on the position when the market rallied. The strength surprised me.

At that moment, the light went off. Everyone has been overly pessimistic about the chances for a European solution. Traders were getting ready to short the market once the news was released. What if the mere appearance of progress temporarily restored confidence? Certainly, the market would embrace a comprehensive solution even if it took a little longer to craft.

After 25 years of trading, I've learned that the market will often screw as many people as possible. Three weeks ago, we broke out of the trading range and the market made a new 52-week low. Bulls ran for cover and speculators bought puts. The next day, the door got slammed in their face. The market rallied 10% in a week and shorts were carried out in body bags.

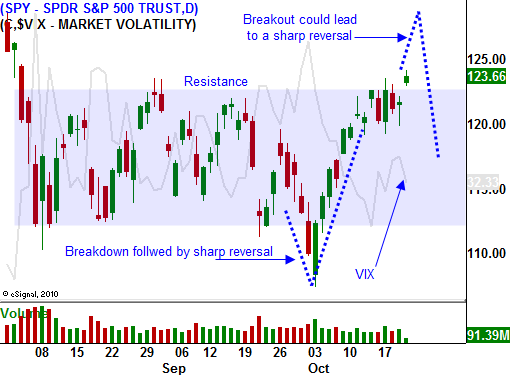

Here is an interesting scenario that I believe will play out. Resistance at SPY 123 has already been penetrated and the market will challenge 125. If we break above that level, shorts will get squeezed and investors will buy stocks on the notion that a year-end rally has started. After everyone piles in, the door will get slammed and stocks will reverse

I told you yesterday that this is historically the most bullish two week period of the year. It is crazy to fade the market during this time even though things feel different this year.

Germany and France said they will have a detailed plan next week. They rolled the release date back to Wednesday so that they can iron out the details. That means the market will push higher the next few days. Anyone that shorted prematurely is going to feel pain.

Once this move runs its course (and we could even rally after the announcement), reality will sink in. A comprehensive plan involving 17 nations can't be drafted in the course of two weeks. There will be many details that still have to get ironed out and a small member nation could throw a wrench into the entire process at any time.

We don't know how large the haircuts on Greek debt will be (50% plus), but credit default swaps will take some heat. Banks are undercapitalized and these losses will have to be realized. France and Germany are still at odds over whether the EFSF should function as a bank or an insurer. Perhaps the biggest question pertains to financing. How big is this "grand bargain"? Europe can't finance it internally and it needs global assistance.

That funding doesn't have to come immediately, but it will be a long-term issue. Initial interest could be decent and the “can” will get kicked down the road. Over time, the appetite for Eurobonds will subside. There has been no talk of structural reform and China has already stated that they will not commit unless they see massive restructuring.

Just around the corner, we will have our own budget cuts to deal with. The Super Committee must trim $1.5 trillion by November 23rd. According to the New York Times and Washington Post this week, no progress has been made. Last night, a smaller $35 billion jobs package was blocked in the Senate. Politicians can't even agree on that.

Earnings have been decent and they will carry the market higher now that the dark clouds have temporarily parted. Optimism will run high and the market will get overextended. It is important to let this move exhaust itself. Year-end rallies can be very powerful and the magnitude of the move often exceeds expectations.

Here is how I want to play it. First of all, I am flat and I don't want to risk any capital at this stage. This clean slate will give me a clear perspective as I evaluate the price action. I believe we will run through SPY 125 in the next few days and short covering could push us to SPY 127. What happens next is critical.

If the market rally stalls and prices reverse, I will buy puts on a breakdown below 125. Speculators who rushed in to buy the market will bail on positions and Asset Managers will take profits ahead of uncertainty. The market could fall back into the middle of the trading range as corporations provide cautious guidance.

If the rally stalls and support at SPY 125 is tested and it holds firm, we might get a decent year-end rally. I see this scenario as unlikely. Global economic conditions are starting to soften and inflation is still a concern. If it happens, I will distance myself from the action and I will sell put spreads. That is as aggressive as I will get on the long side with the market at this level.

Fear and hope are almost impossible to gauge. The market is not rallying because of a solution, it is rallying on hope. Stock valuations are cheap and as long as hope stays alive, prices will move higher.

This is a great time to stay on the sidelines. When I see something good, I will let you know and we will pounce on the opportunity.

Daily Bulletin Continues...