After the Meeting Starts, Buy Puts On A Breakdown. Keep Your Size Small and Have Stops In Place.

I have many loyal readers and traffic motivates me to blog. As you can see, my blog is free of advertisements and I would like to keep it that way. Please help me generate more traffic by submitting your feedback to Investimonials. They have added my blog to their list and you can add your comments if you CLICK HERE. Thank you for taking the time to do this - it means a lot to me.

European officials will be meeting at 12:00 pm ET. They will outline their game plan. The Street would like bank recap of $200B, but it will probably be closer to $100B. The EFSF will probably operate as an insurer and it will raise $1T. Most analysts feel that $2T is needed. Greek haircuts will probably be 50%. France wants 40% (because it its exposure) and Germany wants 60%. The market is expecting all of this - it's the reaction that is impossible to predict.

I feel strongly that this plan is needed to show commitment, but it does not solve the problem. Deficit spending will continue without structural reform. This week, Italy was supposed to raise the pension age to 67 and the cabinet walked out of the meeting without voting. There is also the issue of funding. Who is going to put up this $1.2T? The money can't come from the ECB. Treasury Secretary Geithner already said Europe has enough money. The US contributes the most money to the IMF and it has a bigger voice. Consequently, don't expect much funding from the IMF. China is not interested until it sees reform. Finland and other northern EU members are also reluctant. The countries that need the aid can't contribute - they are already out of money.

This set-up reminds me of the FOMC meeting this summer. Everyone was expecting Operation Twist and they knew it would be ineffective. However, traders were afraid to short ahead of the news. Once the news hit, the market tanked.

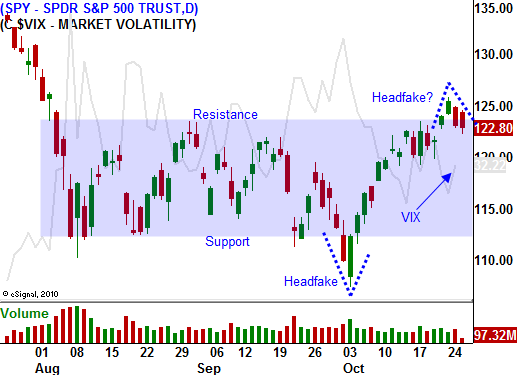

I don't know what the market's reaction will be. Stocks are cheap and Asset Managers want a year-end rally. I don't believe they will chase stocks at the high end of the range. That also leads me to believe that the chance for a selloff is greater than the chance for a blow-off rally.

The economic news has been disappointing. Consumer sentiment was low and this morning durable goods orders fell .8% in September. CMI and MMM also posted weak numbers this week and warned of slowing economic growth.

This is a very dangerous trading environment and you should wait for the news. If the SPY trades below $122.80 after the meeting starts, buy puts. If the SPY trades above $124.20, stop out the trade. I would not chase stocks on the news and I would not get long. I am not afraid of missing a year-end rally and I do not believe Asset Managers are afraid either.

There are still major components of the "grand bargain" that will need to get hammered out and we are bound to hear opposition from stronger EU members.

Daily Bulletin Continues...