100% Europe – Asset Managers Will Wait For Signs of Support.

The overnight news outside of Europe was not bad. China's PMI was just shy of expectations (51.8) and it came in at 50.4. That miss was offset by lower than expected inflation. If prices have stopped going up, China could ease in coming months. Stocks in China posted overnight gains.

Greece is stealing the spotlight once again. The Prime Minister announced plans to hold a referendum on the euro zone deal struck last Wednesday night in Brussels. If it fails to pass this Friday, Greece will officially default. A recent poll taken last weekend shows that 60% of Greek citizens were not in favor of the bailout package. The referendum was completely unexpected and this development has sent a shock wave through the market last night.

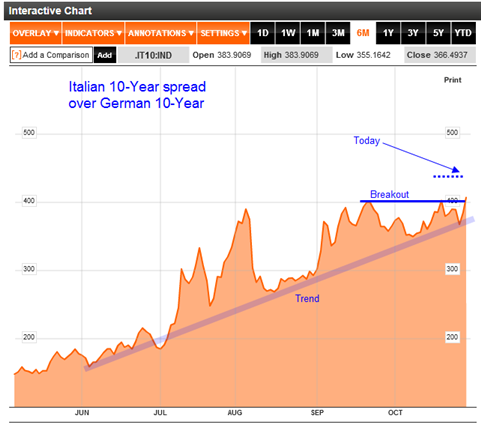

Interest rates in Italy continue to climb. As you can see in today's chart, they have been in a steady uptrend and they are breaking out to new relative high. Risk is getting priced into their sovereign debt and they are on a very slippery slope.

Credit conditions are so fragile this morning that the EFSF has scaled back a €5 billion auction of 15 year bonds. Now they will try to auction €3 billion of 10 year bonds. The proceeds will help Ireland shore up its banks. If Europe can't even auction €5 billion worth of bonds, how will it raise €1 trillion for the "grand bargain"? Borrowing costs are escalating and there is a likelihood that France will lose its AAA rating.

It now appears that last week's breakout was nothing more than a head fake. The Street does not believe that Europe can solve its problems and future rallies will always be challenged.

If Europe had been raising money the last 12 months and if it had forced banks to raise capital (sell assets), Greece could have defaulted and the problem could have been contained. Now they are behind the eight ball and it might be too late. Capital costs in Italy have soared and banks will be selling assets at deep discounts. The appetite for Euro debt has declined in recent days and they have not started raising money.

The FOMC is meeting today and tomorrow. Some traders believe that QE3 will be announced. This is not a consensus opinion. The Fed might hint of future easing via mortgage-backed securities. This rhetoric would keep a small bid to the market.

The economic releases this week should be decent (ISM manufacturing, ISM services, ADP employment, initial claims and the Unemployment Report). They won't add to the selling pressure, but they won't spark a rally either.

I would not exit bullish positions on the open. The bid/ask spreads will be wide. Wait to see how the day unfolds. It's possible that this is a major overreaction and Asset Managers could nibble if support is established by mid-morning.

If the market continues to drift lower throughout the day, look out below.

I am not trying to make money today; I am in damage control mode. I am long calls and I will take a hit. When I get "twisted" like this, I pull in my horns and I trim my size dramatically.

I thought the “grand bargain” was a "sell the news" event last week and the market rallied. As soon as I got on board, the rug was pulled out. When this happens, confidence is shattered. Contain losses and take a giant step backwards.

If I see a nice reversal this morning, I will stick with my long positions. Ideally, the SPY will close above 125. Given the level of fear and the looming Greek vote on Friday, this scenario is unlikely. Traders will error on the side of caution and stocks will drift lower. If that is the case, I will take my lumps and head for the sidelines.

Keep a cool head and be patient through midmorning. You will be able to assess the price action and make a better decision if you wait.

.

.

Daily Bulletin Continues...