Thanks For All of the Reviews! As Promised, Here Is An Options Trade Worth Considering.

Last week I said that I would post a trade if 50 readers posted reviews about my blog. Thank you - we made it! You can still add your comments on Investimonials if you CLICK HERE.

Before I get into the trade, let me state that option trading is not suited for all investors. No consideration has been made for an individual's risk tolerance or suitability. Before you enter the trade, make sure you know all of the risks. OneOption, LLC is not a registered investment advisor and the trade is purely for educational purposes.

The market is in turmoil and investors are looking for a safe place to park money. Currencies are fluctuating and central banks are printing money. An emerging middle class in India and China is also increasing the demand for gold. Miners are having to dig deeper and production costs are rising. The supply is limited and the demand is increasing. That means the price of gold will continue to climb. This summer, China and the CME raised the margin requirements for gold. Traders had to sell some of their positions to meet margin requirements and that sparked a selloff. The trade was very crowded and speculators were flushed out. Gold formed a base and not it is resuming the long term uptrend.

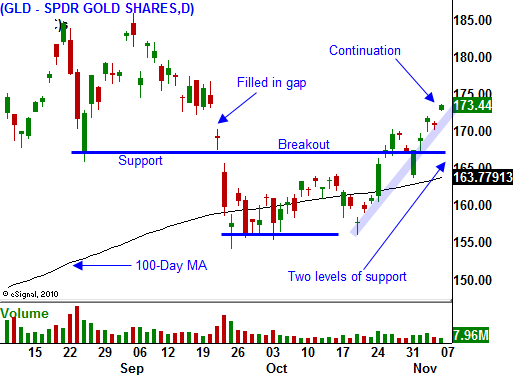

I like selling the GLD December $165 puts and buying the GLD December $160 puts for a $1.00 credit. The Dec $165 puts are $2.52 bid and the Dec $160 puts are $1.51 offer. I do not want to buy calls at this stage. If the market declines, gold could sell off - it is an asset. Baring a major market correction, gold should continue to move higher. At very least, the $165 support level will hold. That is horizontal support and it is just above the 100-Day MA. Place this stop order if you are filled. Contingent on GLD below $163.70 (at anytime before Dec expiration), buy back the put spread - GTC. If successful, this trade would yield a 25% return in 6 weeks. This is called a put credit spread and we will make money if GLD stays above $165. Please look at the chart below for all of the technicals. If you don't understand the trade, don't do it. If you don't know how to place conditional orders, ask your broker for help.

.

.

.

.

Now let's talk about the market - here's where we stand. Earnings releases have been excellent and we are at the tail end of the cycle. Guidance has been guarded, but good. Stocks are trading at a forward P/E of 13 and Asset Managers are hoping for a year-end rally. They have little to show for 2011 and this is their last chance to produce a nominal gain.

Economic releases have been in line, but activity is flat lining. Growth in China has pulled back, but conditions have stabilized. Europe is in a recession and the US is growing at a 2% rate (no inflation adjusted GDP growth). Friday's Unemployment Report showed that 80,000 jobs were created in October. We need 250,000 jobs just to keep pace with population growth. Economic releases won't stand in the way of a rally, but they won't spark buying either.

The Fed and the ECB are accommodative. Unfortunately, low interest rates are not stimulating demand. Fiscal spending will be curbed to balance budgets and that will more than offset any benefits from monetary easing.

When politicians are faced with difficult decisions, gridlock often results. The Super Committee is one example. In the next two weeks they need to reveal their plan to trim $1.5 trillion. According to the New York Times and Washington Post, little progress has been made.

Europe has the same issue. Opposing parties can't agree on anything. Greece's Prime Minister tried to force both parties to agree to the EU bailout. The maneuver ultimately worked, but it cost him his job and it wreaked havoc on the markets. A new interim government will enforce the terms of the agreement and they will deal directly with the EU until elections are held.

Interest rates in Italy continue to spike. Their Prime Minister might be subjected to a confidence vote this week. If he fails, elections will be held. This would cast a great deal of uncertainty on Italy as it prepares for major bond auctions in the next month. It is possible that an interim government is established so that bailout money from the EU can be obtained.

Over the weekend, France approved budget cutting measures in an effort to preserve its AAA credit rating. The retirement age will be raised to 67 in five years (one year ahead of schedule). All of the cost cutting measures are a joke. They barely scratch the surface of what is needed.

This is an extremely difficult market to trade. I believe there is a 70% chance that we could rally 3 to 4% into year-end. On the flipside, I believe there is a 30% chance that the market could fall 10% or more. All it will take is one major news event from Europe.

I could construct a position where I am long twice as many call options as put options. That would require me to identify the strongest stocks that will rally into year-end. To hedge this position I would buy half as many puts on weak stocks.

There are two problems with this strategy. First of all, option implied volatilities are fairly rich and this approach would lose money if the market falls into a trading range. Secondly, half of the positions would take a beating and the other half would have to outperform to breakeven.

If I were going to construct this type of position I would buy puts on financials. If there is a credit crisis, they will get nailed. I would buy calls on cyclical stocks. They have been beaten down on economic concerns and any progress in Europe would push them higher. Asset Managers that missed this rally would also be looking for "unloved stocks" that have room to run.

I'm not a big fan of neutral trading. I like to have a directional opinion and when I can't form one, I don't trade. I am staying on the sidelines and I will wait for clarity. If the market closes below SPY 125, I will take a small put position. I want to see follow-through and if the market can close below SPY 123, I will purchase more puts. I know that I am fading stocks during the most bullish period of the year and I am keeping my size small. If the market closes above SPY 125, I will take my lumps and wait for clarity.

I am not trading the bullish side of the market. I don’t mind missing a 3-4% rally, but I would kick myself if I ignored all of the warning signs and had the rug pulled out from under me.

The market has gotten some excellent news in the last week. Greece will not hold a referendum and a new governing body will interact with the EU. The bailout money is likely to be granted and we know the EU wants Greece to take it. The FOMC statement was "dovish" and the economic slowdown rhetoric was toned down. The ECB lowered rates and that was a surprise move.

Even with all of this good news, the market is soft. There are still too many questions and the G20 meeting yielded nothing. Fear is running high and I sense that stocks want to move lower. If bulls can't muster a year-end rally, things will get ugly in 2012. Be careful!

Thanks again for all of your kind reviews on Investimonials.

.

.

.

.

Now let's talk about the market - here's where we stand. Earnings releases have been excellent and we are at the tail end of the cycle. Guidance has been guarded, but good. Stocks are trading at a forward P/E of 13 and Asset Managers are hoping for a year-end rally. They have little to show for 2011 and this is their last chance to produce a nominal gain.

Economic releases have been in line, but activity is flat lining. Growth in China has pulled back, but conditions have stabilized. Europe is in a recession and the US is growing at a 2% rate (no inflation adjusted GDP growth). Friday's Unemployment Report showed that 80,000 jobs were created in October. We need 250,000 jobs just to keep pace with population growth. Economic releases won't stand in the way of a rally, but they won't spark buying either.

The Fed and the ECB are accommodative. Unfortunately, low interest rates are not stimulating demand. Fiscal spending will be curbed to balance budgets and that will more than offset any benefits from monetary easing.

When politicians are faced with difficult decisions, gridlock often results. The Super Committee is one example. In the next two weeks they need to reveal their plan to trim $1.5 trillion. According to the New York Times and Washington Post, little progress has been made.

Europe has the same issue. Opposing parties can't agree on anything. Greece's Prime Minister tried to force both parties to agree to the EU bailout. The maneuver ultimately worked, but it cost him his job and it wreaked havoc on the markets. A new interim government will enforce the terms of the agreement and they will deal directly with the EU until elections are held.

Interest rates in Italy continue to spike. Their Prime Minister might be subjected to a confidence vote this week. If he fails, elections will be held. This would cast a great deal of uncertainty on Italy as it prepares for major bond auctions in the next month. It is possible that an interim government is established so that bailout money from the EU can be obtained.

Over the weekend, France approved budget cutting measures in an effort to preserve its AAA credit rating. The retirement age will be raised to 67 in five years (one year ahead of schedule). All of the cost cutting measures are a joke. They barely scratch the surface of what is needed.

This is an extremely difficult market to trade. I believe there is a 70% chance that we could rally 3 to 4% into year-end. On the flipside, I believe there is a 30% chance that the market could fall 10% or more. All it will take is one major news event from Europe.

I could construct a position where I am long twice as many call options as put options. That would require me to identify the strongest stocks that will rally into year-end. To hedge this position I would buy half as many puts on weak stocks.

There are two problems with this strategy. First of all, option implied volatilities are fairly rich and this approach would lose money if the market falls into a trading range. Secondly, half of the positions would take a beating and the other half would have to outperform to breakeven.

If I were going to construct this type of position I would buy puts on financials. If there is a credit crisis, they will get nailed. I would buy calls on cyclical stocks. They have been beaten down on economic concerns and any progress in Europe would push them higher. Asset Managers that missed this rally would also be looking for "unloved stocks" that have room to run.

I'm not a big fan of neutral trading. I like to have a directional opinion and when I can't form one, I don't trade. I am staying on the sidelines and I will wait for clarity. If the market closes below SPY 125, I will take a small put position. I want to see follow-through and if the market can close below SPY 123, I will purchase more puts. I know that I am fading stocks during the most bullish period of the year and I am keeping my size small. If the market closes above SPY 125, I will take my lumps and wait for clarity.

I am not trading the bullish side of the market. I don’t mind missing a 3-4% rally, but I would kick myself if I ignored all of the warning signs and had the rug pulled out from under me.

The market has gotten some excellent news in the last week. Greece will not hold a referendum and a new governing body will interact with the EU. The bailout money is likely to be granted and we know the EU wants Greece to take it. The FOMC statement was "dovish" and the economic slowdown rhetoric was toned down. The ECB lowered rates and that was a surprise move.

Even with all of this good news, the market is soft. There are still too many questions and the G20 meeting yielded nothing. Fear is running high and I sense that stocks want to move lower. If bulls can't muster a year-end rally, things will get ugly in 2012. Be careful!

Thanks again for all of your kind reviews on Investimonials.

.

.

.

.

Now let's talk about the market - here's where we stand. Earnings releases have been excellent and we are at the tail end of the cycle. Guidance has been guarded, but good. Stocks are trading at a forward P/E of 13 and Asset Managers are hoping for a year-end rally. They have little to show for 2011 and this is their last chance to produce a nominal gain.

Economic releases have been in line, but activity is flat lining. Growth in China has pulled back, but conditions have stabilized. Europe is in a recession and the US is growing at a 2% rate (no inflation adjusted GDP growth). Friday's Unemployment Report showed that 80,000 jobs were created in October. We need 250,000 jobs just to keep pace with population growth. Economic releases won't stand in the way of a rally, but they won't spark buying either.

The Fed and the ECB are accommodative. Unfortunately, low interest rates are not stimulating demand. Fiscal spending will be curbed to balance budgets and that will more than offset any benefits from monetary easing.

When politicians are faced with difficult decisions, gridlock often results. The Super Committee is one example. In the next two weeks they need to reveal their plan to trim $1.5 trillion. According to the New York Times and Washington Post, little progress has been made.

Europe has the same issue. Opposing parties can't agree on anything. Greece's Prime Minister tried to force both parties to agree to the EU bailout. The maneuver ultimately worked, but it cost him his job and it wreaked havoc on the markets. A new interim government will enforce the terms of the agreement and they will deal directly with the EU until elections are held.

Interest rates in Italy continue to spike. Their Prime Minister might be subjected to a confidence vote this week. If he fails, elections will be held. This would cast a great deal of uncertainty on Italy as it prepares for major bond auctions in the next month. It is possible that an interim government is established so that bailout money from the EU can be obtained.

Over the weekend, France approved budget cutting measures in an effort to preserve its AAA credit rating. The retirement age will be raised to 67 in five years (one year ahead of schedule). All of the cost cutting measures are a joke. They barely scratch the surface of what is needed.

This is an extremely difficult market to trade. I believe there is a 70% chance that we could rally 3 to 4% into year-end. On the flipside, I believe there is a 30% chance that the market could fall 10% or more. All it will take is one major news event from Europe.

I could construct a position where I am long twice as many call options as put options. That would require me to identify the strongest stocks that will rally into year-end. To hedge this position I would buy half as many puts on weak stocks.

There are two problems with this strategy. First of all, option implied volatilities are fairly rich and this approach would lose money if the market falls into a trading range. Secondly, half of the positions would take a beating and the other half would have to outperform to breakeven.

If I were going to construct this type of position I would buy puts on financials. If there is a credit crisis, they will get nailed. I would buy calls on cyclical stocks. They have been beaten down on economic concerns and any progress in Europe would push them higher. Asset Managers that missed this rally would also be looking for "unloved stocks" that have room to run.

I'm not a big fan of neutral trading. I like to have a directional opinion and when I can't form one, I don't trade. I am staying on the sidelines and I will wait for clarity. If the market closes below SPY 125, I will take a small put position. I want to see follow-through and if the market can close below SPY 123, I will purchase more puts. I know that I am fading stocks during the most bullish period of the year and I am keeping my size small. If the market closes above SPY 125, I will take my lumps and wait for clarity.

I am not trading the bullish side of the market. I don’t mind missing a 3-4% rally, but I would kick myself if I ignored all of the warning signs and had the rug pulled out from under me.

The market has gotten some excellent news in the last week. Greece will not hold a referendum and a new governing body will interact with the EU. The bailout money is likely to be granted and we know the EU wants Greece to take it. The FOMC statement was "dovish" and the economic slowdown rhetoric was toned down. The ECB lowered rates and that was a surprise move.

Even with all of this good news, the market is soft. There are still too many questions and the G20 meeting yielded nothing. Fear is running high and I sense that stocks want to move lower. If bulls can't muster a year-end rally, things will get ugly in 2012. Be careful!

Thanks again for all of your kind reviews on Investimonials.

.

.

.

.

Now let's talk about the market - here's where we stand. Earnings releases have been excellent and we are at the tail end of the cycle. Guidance has been guarded, but good. Stocks are trading at a forward P/E of 13 and Asset Managers are hoping for a year-end rally. They have little to show for 2011 and this is their last chance to produce a nominal gain.

Economic releases have been in line, but activity is flat lining. Growth in China has pulled back, but conditions have stabilized. Europe is in a recession and the US is growing at a 2% rate (no inflation adjusted GDP growth). Friday's Unemployment Report showed that 80,000 jobs were created in October. We need 250,000 jobs just to keep pace with population growth. Economic releases won't stand in the way of a rally, but they won't spark buying either.

The Fed and the ECB are accommodative. Unfortunately, low interest rates are not stimulating demand. Fiscal spending will be curbed to balance budgets and that will more than offset any benefits from monetary easing.

When politicians are faced with difficult decisions, gridlock often results. The Super Committee is one example. In the next two weeks they need to reveal their plan to trim $1.5 trillion. According to the New York Times and Washington Post, little progress has been made.

Europe has the same issue. Opposing parties can't agree on anything. Greece's Prime Minister tried to force both parties to agree to the EU bailout. The maneuver ultimately worked, but it cost him his job and it wreaked havoc on the markets. A new interim government will enforce the terms of the agreement and they will deal directly with the EU until elections are held.

Interest rates in Italy continue to spike. Their Prime Minister might be subjected to a confidence vote this week. If he fails, elections will be held. This would cast a great deal of uncertainty on Italy as it prepares for major bond auctions in the next month. It is possible that an interim government is established so that bailout money from the EU can be obtained.

Over the weekend, France approved budget cutting measures in an effort to preserve its AAA credit rating. The retirement age will be raised to 67 in five years (one year ahead of schedule). All of the cost cutting measures are a joke. They barely scratch the surface of what is needed.

This is an extremely difficult market to trade. I believe there is a 70% chance that we could rally 3 to 4% into year-end. On the flipside, I believe there is a 30% chance that the market could fall 10% or more. All it will take is one major news event from Europe.

I could construct a position where I am long twice as many call options as put options. That would require me to identify the strongest stocks that will rally into year-end. To hedge this position I would buy half as many puts on weak stocks.

There are two problems with this strategy. First of all, option implied volatilities are fairly rich and this approach would lose money if the market falls into a trading range. Secondly, half of the positions would take a beating and the other half would have to outperform to breakeven.

If I were going to construct this type of position I would buy puts on financials. If there is a credit crisis, they will get nailed. I would buy calls on cyclical stocks. They have been beaten down on economic concerns and any progress in Europe would push them higher. Asset Managers that missed this rally would also be looking for "unloved stocks" that have room to run.

I'm not a big fan of neutral trading. I like to have a directional opinion and when I can't form one, I don't trade. I am staying on the sidelines and I will wait for clarity. If the market closes below SPY 125, I will take a small put position. I want to see follow-through and if the market can close below SPY 123, I will purchase more puts. I know that I am fading stocks during the most bullish period of the year and I am keeping my size small. If the market closes above SPY 125, I will take my lumps and wait for clarity.

I am not trading the bullish side of the market. I don’t mind missing a 3-4% rally, but I would kick myself if I ignored all of the warning signs and had the rug pulled out from under me.

The market has gotten some excellent news in the last week. Greece will not hold a referendum and a new governing body will interact with the EU. The bailout money is likely to be granted and we know the EU wants Greece to take it. The FOMC statement was "dovish" and the economic slowdown rhetoric was toned down. The ECB lowered rates and that was a surprise move.

Even with all of this good news, the market is soft. There are still too many questions and the G20 meeting yielded nothing. Fear is running high and I sense that stocks want to move lower. If bulls can't muster a year-end rally, things will get ugly in 2012. Be careful!

Thanks again for all of your kind reviews on Investimonials.

.

.Daily Bulletin Continues...