Italian Interest Rates Reach Point of No Return – Buy Puts If the SPY Closes Below 125.

Yesterday I warned you not to get lured into the rally. If my advice paid off for you, please take a few moments to review my blog on Investimonials. I don't advertise on my site and I am motivated by your comments and by new traffic. You can post your review of this blog on Investimonials if you CLICK HERE.

Tuesday, the market rallied into the closing bell and it broke through the 200-day moving average. The move was orderly and many traders were sucked in.

The news did not support the bullish reaction. How does a new Prime Minister in Italy restore confidence? Berlusconi is a womanizing playboy, but he was not the problem. Italy has so much debt that they were desperate. They were willing to look beyond his shortcomings when they elected him. Citizens felt that a billionaire businessman might be able to solve the problem.

As Prime Minister he pushed for austerity. In a cabinet meeting two weeks ago, members physically attacked each other when they were trying to raise the retirement age to 67. Berlusconi agreed to this in a prior meeting with the EU. Budget cuts are being fought "tooth and nail". The leadership is up in the air and we should not expect that to change.

A new Prime Minister could be appointed or an interim government could be established. Italy should try to avoid an election since it would take months. Uncertainty is wreaking havoc on their sovereign debt and interest rates are skyrocketing today. Italy will be holding large bond auctions in coming weeks and the cost of capital is skyrocketing.

Berlusconi said that he would resign if the new budget is passed. Unfortunately, we don't know what it includes since it has not been drafted yet. If this takes a week to hammer out, the vote could be two weeks away. The market will drop as investors head for the sidelines.

Interest rates in Italy have reached the danger zone. Margin requirements will be raised by 15% and this will force bondholders to liquidate positions so that they can meet the new requirement. This selling pressure will push Italian interest rates even higher and they will reach the point of no return. The ECB has been buying Italian debt in an effort to keep interest rates down. Even with that support, rates have climbed higher. Last week, the ECB warned Italy that it would stop buying bonds if they did not pass austerity measures.

The situation in Italy and Greece is dire. In Greece, we still don't know about the new governing body. There are lots of loose ends and the EU is coming apart at the seams. The EFSF has not raised a dime in capital and the organization still only has a handful of employees. European banks are afraid to issue equity or debt. They know the cost of capital is sky high.

European officials had the opportunity to act this summer, but they went on vacation instead. Every action takes months to implement and they needed to be proactive. Now the EU is caught flat-footed just like a “deer in the headlights”.

The Super Committee's defining moment is a couple of weeks away. Bloomberg, the Wall Street Journal, the New York Times, Politico, the Washington Post and the Associated Press have all reported gridlock. They do not believe the Super Committee will meet its deadline. If this transpires, Fitch or Moody's will downgrade our credit rating. That will spark a selloff in US equities and we will no longer be a "safe haven".

China's CPI was in line and Asian markets were stable. Unfortunately, the news was not good enough to prompt their central bank to reverse monetary policy. China may not tighten, but they are months away easing.

Economic conditions have stabilized after a pullback the last few months. The numbers are market neutral and they should not influence trading one way or the other. Earnings releases are tapering off and retailers will dominate the announcements the remainder of the week. Retail sales disappointed last week and the news should weigh on the market.

Asset Managers desperately want a year-end rally. The seasonal strength is so strong that it has been able to overpower all of the bad news to this point. Yesterday's rally was a perfect example. Berlusconi said he would resign and stocks broke through the 200-day moving average in the midst of uncertainty.

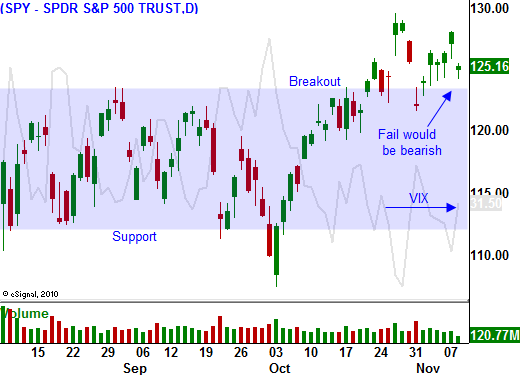

Stocks are back below SPY 125 and I am buying puts today if the market can close below this level. If the market continues to decline, I will add to the position if SPY 123 is breached.

If the selling pressure persists, Asset Managers will pull their bids. The fear of missing a year-end rally will subside and they will wait for support to be established. Once we reach that point, bullish speculators will bail out of positions and we will hit an air pocket. That could lead to a nice support level and a buying opportunity into year-end. It could also be the beginning of a nasty decline if interest rates in Italy continue to spike and if the Super Committee strikes out.

At this juncture, I am only trading from the bearish side. If I buy puts and I get stopped out, so be it. I will wait for the next entry point.

I believe the market will continue to decline late in the day and we will close on the low. Credit conditions are deteriorating and there is not a solution in sight. Buyers have been able to prop the market up off of the lows, but they will get tired late in the day. Don't jump the gun, wait for confirmation that we will close below SPY 125 and then buy puts.

Daily Bulletin Continues...