SPY Below $127.50 – Stay Short. Bad News From Europe and DC Likely.

Last week, the market recovered on news that Italy and Greece would appoint new Prime Ministers. In both cases, the old Prime Ministers promised to step down if certain actions were taken. A leadership change won't change the situation.

Greece and Italy have massive structural issues. Without entitlement reform, bailouts and austerity won't plug the hole. Each year they slip further and further into debt and that will only accelerate as their economies contract.

Next year, Italy has €220 billion in debt that is maturing. It has to roll that over at sky-high interest rates. Additionally, they will run a €30 billion deficit. That means they need to raise €250 billion at a time when perceived credit risk is high. Banks saw 200-year old Man Group go bankrupt last week after it invested too heavily in Greek debt. The appetite for Italian bonds will be soft.

This morning, Italy successfully auctioned €3 billion in five-year bonds. The yield was 6.3% and the bid to cover was a fair 1.47. Yields jumped 1% from the auction a month ago. If the ECB were not purchasing Italian debt, the interest rates would be much higher.

On November 20th, Spain will hold elections. Most analysts believe that there will be a political change there as well. Their unemployment rate is over 20% and conditions are dire.

Standard & Poor's placed Hungary's credit rating and a downgrade from BBB- is possible. Another credit crisis can surface at any time in the EU. Belgium, Ireland, and Portugal are also teetering.

The EFSF has not raised any money. With Italy and Spain in the fray, they will quickly run out of capital if a crisis arises. The EU moves very slowly and it needs to raise money from its members now. If they wait for crisis, it will be too late.

There are a few encouraging signs from Asia and those markets are trading higher overnight. Japan's economic activity has rebounded after the tsunami and China's inflation rate is declining.

In the US, retailers will be posting results this week as earnings season winds down. Revenues have been soft and this could weigh on the market.

There are a number of economic releases slated this week. They include PPI, retail sales, Empire Manufacturing, CPI, industrial production, initial claims, the Philly Fed and LEI. Overall, inflation will be mild and manufacturing will be stable. These releases won't stand in the way a rally and they won't spark a selloff.

Greece and Italy are enjoying the "honeymoon" with their new prime ministers. That euphoria will fade quickly as tough austerity measures are implemented. In Greece, one party has already stated that they will vote against austerity measures. Most analysts still believe that the troika will grant Greece its bailout money. They have come too far to deny them now. Next spring, they will need more money and we will go through this process again.

In a few days, the Super Committee will become a focal point. The Congressional Budget Office needs to see the plan next Monday so they can review it prior to the deadline on November 23rd. Major newspapers have been reporting that no progress has been made. There is a rumor that the Super Committee might agree to dollar amounts for tax revenue hikes and entitlement cuts that would equal $1.2 trillion. It would pass those guidelines over to Congress so that they can haggle over the details. This would postpone the process for another 3 to 4 months and the credit agencies would not view this solution favorably.

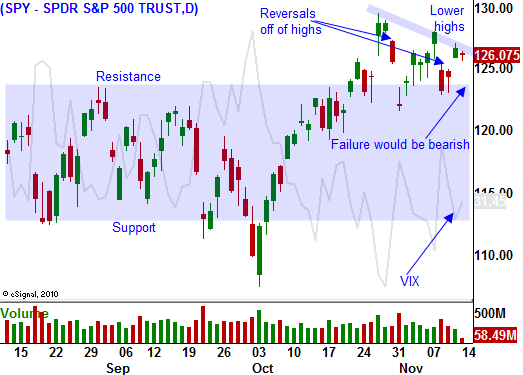

The market desperately wants to rally into year-end. Asset Managers have little to show for 2011 and they want to "goose" performance. Seasonal strength is keeping a bid under the market. However, European credit concerns keep flaring up and the Super Committee is in gridlock. I believe the 200-day moving average will remain intact this week. Stocks are bumping up against resistance and it will take a major accomplishment from Europe or Washington DC to push stocks through.

As long as the SPY stays below $127.50, I am maintaining my short positions. I feel the likelihood of bad news is greater than the likelihood of success. Keep your bets small. The market could break either way and the risk is high.

Daily Bulletin Continues...