Ominous Backdrop Is Keeping Me Short As Long As the SPY Stays Below $127.50.

Yesterday, the market showed some resilience. It was able to overcome early weakness and it rallied throughout the day. Asset Managers that missed the rally a month ago are playing catch up and the bid is strong.

Interest rates in Italy and Spain are near their highs of the year this morning. The ECB is not as active in the sovereign debt market as it was a week ago. European officials are slow to act and the EFSF won't be operational for another month. Italy has €30 billion worth of bonds to auction in the next month and with a passive ECB, interest rates are likely to climb higher.

New Prime Ministers in Italy and Greece won't change anything. Politicians don't like pain and they will object to austerity measures and entitlement changes. The "honeymoon" will end soon and massive demonstrations are already planned in Greece next week.

France is not immune to the credit crisis. Its economy is weak and it risks a credit downgrade. Interest rates in France have been creeping higher and they are at the highs of the year.

The Bank of England (BOE) lowered its growth projections for 2012. It now believes GDP growth will be less than 1%. Economic contraction will reduce tax revenues and deficits will grow.

China has been trying to control inflation and it has slammed on the brakes this year. Prices have stabilized and many analysts believed that China would ease soon. Cold water was splashed on that theory this morning. An adviser to the Peoples Bank of China said that the government is unlikely to loosen macroeconomic controls anytime soon.

In the US, the Super Committee is in full focus. They need to reach an agreement by November 23rd, but the deadline is actually Monday since the Congressional Budget Office needs two days to review the plan. This morning, Politico said that no deal is in sight and Republicans are fighting amongst themselves with regard to revenue increases.

Republicans were willing to increase revenues by $300 billion, but Democrats want $800 billion. Obviously, Democrats want the lion's share of the $1.2 trillion to come from tax increases. I have not heard one word about entitlement reform. Social Security and Medicare/Medicaid are swiftly pulling us deeper into a debt spiral and entitlement needs to be addressed.

This is the same problem Europe faces. Workers are retiring and instead of paying into the system, they will be drawing from it. Deficits will continue to escalate in coming years and politicians don't have the "balls" to tackle the problem.

The Congressional Budget Office projected that Social Security would pay out more than it receives in 2016. Their "rosy" estimates were off by six years and the US has reached that point last year. It will only get worse as “baby boomers” retire.

Washington could come up with a half baked solution next week. Republicans and Democrats could agree to general dollar amounts for spending cuts and tax increases. The details would be hammered out by Congress. This scenario would surely include accounting gimmicks and inflated economic projections. If this comes to pass, ratings agencies will see right through it and our credit rating will be downgraded.

Another possibility is that no agreement is reached. Senator Reid and Speaker of the House Boehner have already implied that they will permit the automatic $1.2 trillion in spending cuts to happen. If this does not get blocked, our credit rating might not get downgraded. However, if the process is delayed, Fitch and Moody's are likely to take action. According to the London Times, half of all institutional investors believe that the US will be downgraded within the next two years.

The Super Committee could not even trim $1.2 trillion off of our deficit during the next 10 years. President Obama urged them to find another $700 billion for his "jobs plan". Both parties are polarized and the stakes have never been higher. What a miserable failure on the part of a bipartisan committee.

The economic news has been stable. I heard people rejoicing over the .6% increase in retail sales yesterday. This is the first decent number in months and when you strip out inflation, it's nothing to write home about. Retailers have been reporting earnings and they are dismal. Prices have been slashed and margins are down. Furthermore, guidance is very cautious. The higher sales can be attributed to discounting.

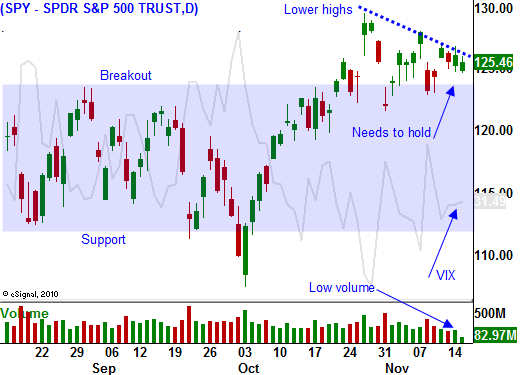

Asset Managers have been trying to prop up this market. There has been sufficient selling at the high end of the range and the market has not been able to break out. Newly elected Prime Minister's will be appointing their cabinets and fear has eased temporarily.

Asset Managers that missed the rally are probably getting caught up and they no longer fear a run-away rally into year end. The bid should be more passive ahead of major news in the next week.

I still believe that Europe is a powder keg. One bad news item could lead to a sharp selloff. Interest rates continue to climb and that is a major warning sign. A nice market pullback would flush out bullish speculators and it would give Asset Managers an opportunity to scoop stocks at better levels.

Europe is in a recession, China is not easing, global austerity is going to take affect shortly, economic growth is flat in the US, sovereign interest rates are climbing and the Super Committee is not going to meet its deadline. The backdrop is very ominous and I will hang on to my put positions as long as the SPY stays below $127.50. That resistance level has held after three tests.

The market has recovered from early lows this morning. I do not believe we will have any late day breaking news and the market is likely to drift lower this afternoon. I feel that bulls are getting tired and they will pull bids. I am going against the grain on this call since stocks have been strong after Europe closes.

I’m not too concerned about the wiggles and jiggles. As long as the market stays below SPY 127.50, I will stay short.

.

Daily Bulletin Continues...