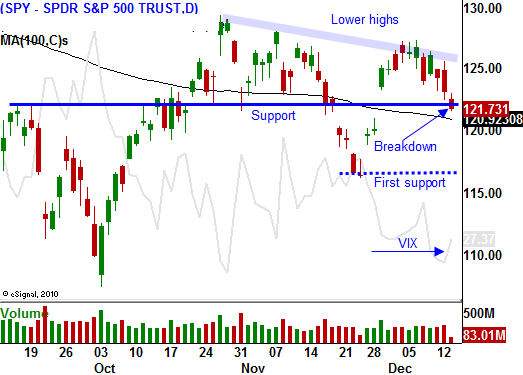

SPY Breaks Below 123. Buy Puts In Small Size – Add On Follow Through!

My comments this week have been fairly lengthy and the same theme has been replayed so many times that you probably know what is driving the market. European credit concerns are weighing on the market and last week's summit was nothing more than lip service.

Eurocrats all reached a unanimous decision that fiscal policies need to be added to the EU treaty. Given this "huge" accomplishment, they all deserve a vacation. Now they will go on holiday and the market will fester for weeks. When they reconvene, months of haggling and gridlock will postpone a decision.

Half of the EU members are already "underwater" and any reasonable policies would impact them immediately. In order to pass the amendments, a unanimous vote is required. There is no way that all of the EU members will agree to strict fiscal policies.

In an effort to stop the current bleeding (rising interest rates throughout Europe), the ECB is granting European banks unlimited access to three-year funds. They want banks to stop selling European sovereign debt and they hope the banks will actually start participating in sovereign debt bond auctions. They can execute a carry trade and borrow at 1% and earn 7% on Italian bonds.

In my opinion, this will fail. European banks did not recapitalize in 2009 like US banks did and they did not take write-downs. Their balance sheets are weak and they are laden with toxic assets. They will not add garbage when they have worked hard to liquidate it. Even if the ECB backstops the banks, none of them want to be a bailout poster child.

Two months ago, a medium-sized bank (Dexia) required a bailout. France and Belgium immediately stepped up to the plate. In a matter of weeks, the bank said it would need more money than it originally asked for and both countries said they can't afford to put in any more money. This is only one bank, imagine what would happen if a number of banks went under.

In November, Greek banks deposits declined by 4.5%. People are pulling their money out and this is an early sign of a run. Remember, banks only hold 20% in reserve and a quarter of that walked out the door in a month. In November, money market funds reduced European exposure by 9%. This liquidity strain prompted the Fed to provide unlimited funds to the ECB. In essence, they just reduce the swap rate by .5% and this action sounded good, but it really doesn't accomplish much.

All non-European members of the IMF are opposed to having the $200 billion go into a general fund. They do not want to use the money to bail out Europe.

S&P is reviewing all of the European nations and credit downgrades can be expected. This is weighing on the market. A single downgrade to France is expected, but a double downgrade would spark a market selloff. No one expects Germany to get downgraded, but S&P said that it is reviewing all countries. If Germany gets downgraded, we will see heavy selling. I believe Germany's credit rating will remain intact but the outlook will be reduced to negative.

The FOMC statement reiterated that credit risk is still high. Stocks were weak before the release and the selling pressure picked up late in the day Tuesday.

This is normally a quiet period for the market. The earnings and economic news is light and stocks typically drift higher on year-end buying. Stocks have been drifting lower and the SPY broke support at 123. This is a very bearish sign for the rest of the year and it does not bode well for 2012.

I bought some puts early this morning and I will add to the position if the market continues to drift lower throughout the day. S&P's downgrades could be very damaging and the market doesn't believe that Europe can solve the credit problems.

We might finally have the breakdown we are looking for. Keep your size small initially. We've seen plenty of whipsaws and the price action has been random. We need to see follow-through before we add to the put positions. Given all of the uncertainty, I expect to see stocks selloff into the close.

Daily Bulletin Continues...