The Rally Will Start To Fade In the Next Few Days – Watch For Signs Of Weakness

Not much has changed in the last 24 hours. Yesterday, stocks tested the downside but they rebounded throughout the day. Trading volumes are declining and we can expect a narrow range today.

The ECB released its bank loan information yesterday and European banks borrowed €498 billion in the last 2 weeks. Most used the cheap 1% funds to pay off higher rate loans and some used the proceeds to buy short-term sovereign debt. Some of the bigger banks in Spain drew enough to cover their refinancing needs in 2012. This is not a sign of optimism; it is a sign of caution.

Tuesday, the market skyrocketed on the notion that European bank loans would be huge. Once the momentum was established, short covering fueled the next leg of the rally. The theory is that banks will draw huge reserves from the ECB and they will use all of this money to support sovereign bond auctions. This is important since the ECB said that it will not expand sovereign debt purchases.

Banks were stressed and they desperately needed the liquidity. The ECB has reduced the collateral requirements needed for loans and banks are pledging anything that meets the minimum requirement. Spain auctioned six-month bills and the demand was high. Banks won’t hesitate to buy up short-term maturities when the yield is high and the default risk is low. I don't believe banks will use the proceeds to support bond auctions where the maturity is more than a few years.

The ECB tried this maneuver in 2008 and banks gobbled up longer-term sovereign bonds. Now those investments have soured and banks are left with huge losses. I don't believe they will make the same mistake twice.

Next year, European banks and sovereigns will struggle to refinance $2.6 trillion of debt. The supply of new debt will be huge and the auctions will not go well if Europe drags its feet. Eurocrats don't have another summit scheduled and the market will get very nervous. Adding fiscal policies to the treaty will be an enormous task and they need to get started immediately. They have a March 2012 target, but I believe they will miss this by a year.

France has a presidential election in April and that will postpone the process. Sarkozy will be more concerned with getting reelected than a credit crisis in the EU.

Standard & Poor's was supposed to release its European credit rating review. Now it looks less likely to happen this week. The liquidity is drying up and I doubt they will stuff coal in everyone's stocking by announcing this Friday. If this gets pushed back to January, any market rally will be contained. Fitch will review European credit ratings before the end of January and Moody's will post his review sometime in the first quarter.

The economic news this morning was mixed. GDP came in lower than expected (1.8%) and jobless claims fell 4,000 (362,000). The market did not have much of her reaction to the news.

Intel, Caterpillar, Schnitzer Steel, Xilinx and Oracle have provided disappointing guidance. Additional warnings before earning season could weigh on the market. During the last 10 months, stocks have rallied ahead of earnings. If that pattern is broken, it would be a very bearish sign.

The House has rejected the extension of payroll tax credits and unemployment benefits. Republicans are divided and if they can't come to terms. These two programs could lop 1% off of GDP in 2012 if they are not passed. Democrats will tighten the thumbscrews ahead of an election year and I believe the House will pass the extensions.

I read a very interesting article about the housing bubble in China this morning. Real estate prices have dropped 35% or more in many major metropolitan areas and there are ghost towns. Residential construction accounts for 10% of GDP in China. During our housing bubble peak, it only accounted for 6% of our GDP. Half of our job growth from 2001 through 2005 was tied to the housing market and when that bubble burst, unemployment skyrocketed. Chinese steel production is down 15% this year and nearly 1/3 of steel producers are losing money. If current commercial projects are completed there will be over 30,000,000,000 ft.² of office space, enough for a 5 x 5 cubicle every man woman and child.

Jim Chanos is a brilliant hedge fund manager and he said that real estate sales from September-October (peak months) were down 40% to 60% year-over-year. Caterpillar guided lower and they sell construction equipment in China. The Shanghai index is making a three-year low and there are plenty of warning signs. China could be another concern in 2012.

The rally this week felt good to investors, but it will be short-lived. I believe we have one or two more days of upside and then the market will decline. European banks are pledging junk so that they can add to dollar reserves. Global financial institutions were reducing Euro risk and this only confirms how dire the situation was. The market will stew while European officials go on holiday and interest rates will climb. The "smart money" will start to sell into strength and this short covering bounce will quickly lose its steam.

I have not been able to get a good read on the market in the last two months. The price movement has been very random with huge overnight gaps in both directions. Now, I feel like I am getting a good read on the market.

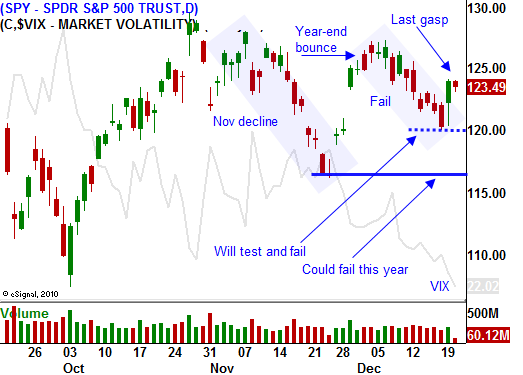

The next big move will be down. Even if the market somehow jumps to SPY 130, that does not constitute a year-end rally. This was the third year of the presidential term and that has historically been gangbuster. The fact that we are closing the year on a whimper does not bode well for 2012.

I believe resistance at SPY 125 will hold today. In the absence of news, we might push through it tomorrow. I am watching for signs of selling. If the market moves into negative territory today, I will buy a handful of puts. If the market closes below SPY 123, I will add quickly. Even with my bearish sentiment, I will not take more than 50% of a normal position. Liquidity is drying up and that increases the level of risk.

Look for an opportunity to get short and keep your size small.

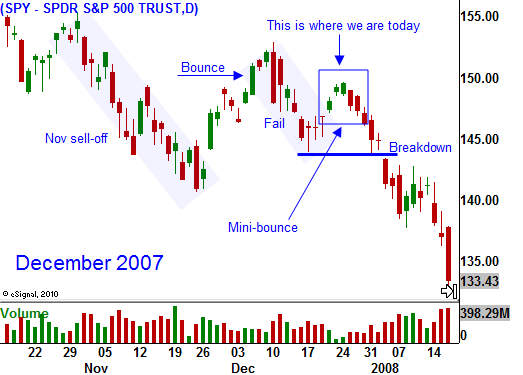

The trading similarities between December 2007 and December 2011 are striking and I will keep these charts up for two more days. If the pattern continues, we will roll over in the next few days.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.Daily Bulletin Continues...