The Market Will Be Very Quiet During the Next Week. Watch For Signs of Resistance

Very little has changed overnight and we can expect quiet trading today and next week. In the early going, the market seems to like the unlimited three-year funds provided by the ECB to European banks.

In theory, they are going to be using the proceeds to buy sovereign debt. European banks have taken huge losses on sovereign debt this year and I doubt they will be active in maturities that are longer than one year. Spain auctioned 6 month bills this week and everyone got excited by the demand. The real tell will come when 5 year bonds are auctioned.

The ECB's balance sheet has not been this large since the financial crisis in 2008. They lowered the collateral requirements and banks are pledging whatever they can to access funds. In just two weeks, banks tapped the ECB for $498B. From my perspective, this is a sign of weakness and it shows just how dire the situation was.

Many European banks need to refinance debt next year. They know the cost of capital will be high so they grabbed enough three-year funds to cover their needs for 2012 in case bond auctions go poorly. The only good news is that they are not going into an immediate collapse.

European banks and sovereigns need to refinance $2.6 trillion worth of debt in 2012. This supply will put tremendous strain on bond prices and the ECB is hoping that European banks will be there to buy up the debt. That is how this plan is supposed to work. Banks are hoarding cash and I feel the plan is doomed.

Reuters reported two weeks ago that Standard & Poor's was going to release its credit ratings review in December. They are very reliable news source. Unfortunately, I relied on their information and they were wrong. Now it appears all three major ratings agencies will release their reviews in Q1. I still believe that S&P will release early in January. A few weeks later, Fitch will chime in with this review.

This morning, the House extended payroll tax credits and unemployment benefits (two months). This was largely expected and the market did not have much of a reaction.

The storm clouds have temporarily parted and the price action during the next week will be very telling. Stocks should be able to drift higher in the absence of news. If the rally can't gain traction, we will have our first warning sign. This resistance will signal that Asset Managers are selling into strength ahead of 2012.

Companies that have released in the last two weeks have provided weak guidance. This will raise some concerns and the European credit ratings will start to weigh on the market.

I have been reading in-depth articles on China's economic condition and I believe they could be in for a hard landing in 2012. They will be posting their official PMI next weekend. On Thursday, HSBC will post its PMI reading for China and that could spark a little selling if it comes in below 49.

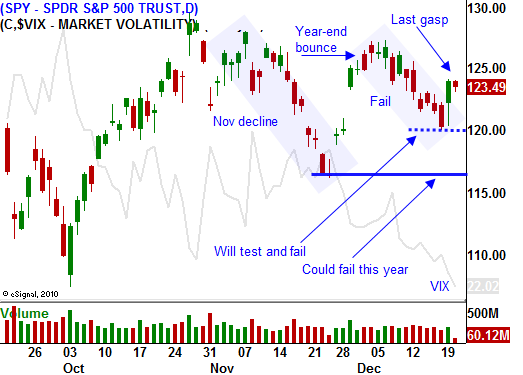

The SPY is clearly above resistance at 125. The market floated up on light volume yesterday and those gains will be easy to strip away if there is a sliver of bad news. I am on the sidelines and I am looking to buy puts. If the SPY closes below 125, I will buy a handful. I need to see follow through selling before I add.

We've had a great year and there is much to be thankful for.

May you and your families be blessed this holiday season!

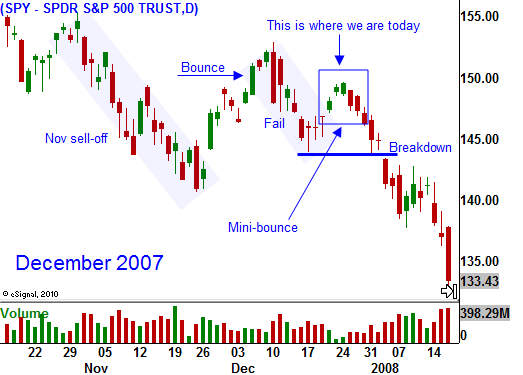

The trading similarities between December 2007 and December 2011 are striking and I will keep these charts up for two more days. If the pattern continues, we will roll over in the next few days.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.Daily Bulletin Continues...