Financials Will Dominate Earnings – Comps will Be Tough. Resistance Is Holding

In the last few weeks the market rally has been characterized by light volume overnight gaps. This is not a healthy sign. Let's review some of the issues weighing on the market.

China's economy is slowing down. In 2011 they slammed on the brakes by raising interest rates and bank reserve requirements six times. Their Finance Minister painted a very weak picture for Q1 and he cited rising costs. China's CPI came in higher than expected last night and that might postpone easing.

Economic conditions in Europe are also slowing down. Yesterday, Germany (the strongest/largest country) reported that Q4 GDP declined .1%. I believe Europe is already in a recession and austerity programs have barely started.

The ECB avoided a financial crisis in November when it extended unlimited three-year funds to European banks. Euro banks gobbled up as much as they could and the ECB's balance sheet is as big as it was in 2008. In just two weeks, European banks borrowed €500 billion. This move temporarily avoided a crash, but its benefits will be short-lived.

In theory, European banks were going to lend these funds to sovereigns. First of all, the banks needed this money because their liquidity was drying up. They refinanced some of their other loans with lower cost ECB funds. These banks are straddled with PIIGS debt and they are suffering huge portfolio losses. They won't make the same mistake twice.

Société Generale is one of Europe's largest banks and their CEO said that they will not be buying sovereign debt. He does not feel that European banks should be "the buyer of last resort". I suspect that all European banks feel this way. The ECB said that they will not be buying sovereign debt either. That means interest rates will continue to climb.

Italy and Spain held successful overnight auctions. However, these were short-term bonds (1 to 3 years) and banks will sponsor these since they mature before the ECB terminates its three-year program. If Basel III were passed, 21/28 European banks would fail.

Greece is back in the headlines and larger haircuts (greater than 50%) will have to be taken. The IMF is not pleased with Greece's lack of progress and it barely secured the last bailout payment.

In the next two weeks Standard & Poor's and Fitch will release their European credit review. Many downgrades can be expected and interest rates will rise.

From an earnings standpoint, this is been one of the busiest preannouncement seasons in the last decade. Earnings estimates have been cut in half. For the first time in two years, profits will grow at a single-digit rate.

Energy companies comprise a huge part of the S&P 500. Oil prices are lower than they were a year ago and that will impact earnings. Last night, Chevron warned.

Tech stocks will struggle because of supply issues. The floods in Thailand are to blame.

This morning, retail sales were only up .1%. That was less than expected and the holiday season could be very disappointing. Stores discounted deeply and they were open longer.

Financials reduced bad loan reserves and when they shifted that money inflated earnings. Year-over-year comps will be down and banks will dominate the earnings scene next week.

From a seasonal standpoint, we did not get a year-end rally during the third year of a presidential term. That is a very bearish sign. The Santa Claus rally produced a tiny gain and stocks have not jumped higher ahead of earnings season for the first time in ten quarters.

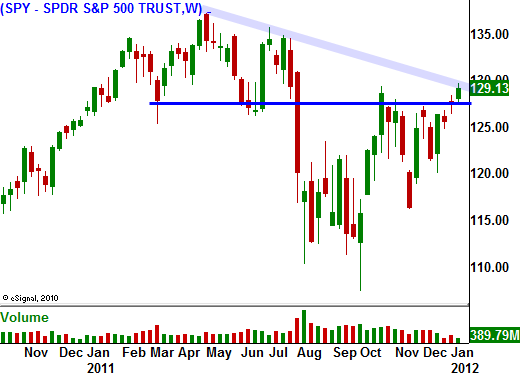

From a technical standpoint, stocks are right up against major resistance. A cup and handle pattern has formed and a breakout would be bullish. Unfortunately, the volume during this rally has been very light and the moves have resulted from news related overnight gaps. The level of conviction is very low and I don't believe a sustained rally is in the cards.

Asset Managers don't want to chase stocks at the top of the range when the backdrop is so uncertain.

I am still hanging on to my put positions. The price action this morning looked weak and I started buying February puts on financials. J.P. Morgan will release tomorrow morning and they will set the tone for the sector. This is the strongest bank and the results should be better than the rest.

I am also buying VIX calls. Option Implied volatilities are dirt cheap and S&P could release its Euro credit review any day. Asset Managers only rolled 10% of their protection in December and sooner or later, they will be buying puts. When they do, the premiums will rise.

If the SPY does not close below $128 today, I will sell my Jan puts. Monday is a holiday and I don't want time decay to strip away the remaining value.

If the market makes a new afternoon low, I will buy more Feb put options. I am not getting overly aggressive yet. There could still be one more push higher when AAPL, IBM, GGOG and INTC announce. That could push the SPY through 130 and spark short covering. A reversal off of that high would be my sign to ramp up. If we never get that push higher and stocks start to slip, I will use late day selling as a sign to buy more puts.

Look for quiet trading today.

Daily Bulletin Continues...