Strong Jobs Number and ISM Services Push Stocks Up To Major Resistance Level

Today, we might have gotten the catalyst the market has been looking for. First, the jobs number came in much better than expected. Next, ISM services jumped from 53 to 56.8. The economic news was excellent and the market gaped higher on the open.

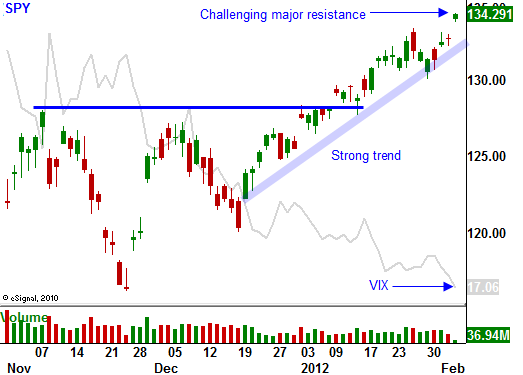

Unlike the price action during the last two weeks, stocks feel like they want to grind higher. The market is challenging a major resistance level at SPY 135 and it doesn't feel like it's going to back off.

This week the PMI's in Europe and Asia were pretty good. Interest rates in Europe were stable and the threat of a credit crisis has subsided. Domestic economic releases were very positive and earnings have been decent.

As long as traders "believe" in the ECB, stocks will move higher. Corporate balance sheets are strong and valuations are attractive. Interest rates are at historic lows and that will force investors into riskier assets.

The key to the market is perception. For all of the positives I've just mentioned, there is a negative side as well. The market is discounting the problems and investors are "going with the flow".

The ECB is accepting sovereign debt as collateral for new loans to European banks. They are hoping that this money will be used to purchase additional sovereign debt. These countries need to continually issue new debt because they are running huge deficits. In the early going, the plan is working, but this can change in a matter of weeks.

Greece has not been able to agree on haircuts and no one seems to care. Traders are so numb to the news that they don’t care if there is a default. This might be the sentiment now, but they will care if it happens.

Eurocrats are forging a meaningless policy that will require EU members to trim deficit spending over decades. The policies won't be enforced and this action is simply lip service for investors.

Conditions in China are deteriorating. Their economic growth is very dependent on residential housing and prices/unit sales are declining. Foreign investments are leaving the country and they could be in for a hard landing. Hyper-growth leads to excess and they have been in this mode for more than a decade.

Our unemployment report contained major workforce revisions that stemmed from the Census Report. Analysts will argue that it now we are getting an accurate picture of what's happening in the economy. That might be true, but it's important to remember that this spurt in job growth was not entirely due to hiring.

Earnings reports are beating estimates, but this is the worst showing in over two years. Analysts trimmed their projections by 50% heading into earnings season and the numbers should have been easy to beat.

As I mentioned, there are two sides to every coin. If the market closes above SPY 135, I will cover my shorts in financial stocks. If that happens, I will place good till cancel contingency orders to buy puts on financial stocks when the SPY falls back below 125. Those orders might get triggered in a week or in a few months. This sector is a screaming short and I want to get back in at the first sign of trouble.

Unfortunately, the overnight gaps have not allowed me to get long stocks intraday. Today I am buying a handful of calls so that I can hold the positions overnight. This will help me shoulder future overnight gaps.

I am still long VIX calls. If the market closes above SPY 135, I will buy calls on cyclical stocks and I will also buy more VIX calls. I still feel that conditions could change very quickly and I will maintain a hedged position during what I believe is the final stage of this rally.

The economic news is very light next week and today's momentum could carry over.

I am not ready to shift gears just yet. I am only buying a handful of calls for overnight protection. The market still needs to convincingly close above SPY 135 for me to add to long positions. If I don't see the follow through and stocks get slapped down from this resistance level, I will wait for bearish follow through. If I see it, I will buy more puts on financial stocks.

Let's see if we finally get a breakout.

Daily Bulletin Continues...