Calendar Is Light. Look For A Small Rally Into the Close. ECB Could Provide A Spark Thurs.

The calendar is very light and there aren't many market moving events scheduled this week. Stocks have tested the downside intraday and they have rallied back before the close. This pattern has developed in the last few days. We are caught in a range and the market is searching for its next catalyst.

The news is generally positive. Rumor has it that Greece is getting closer and closer to a deal. European banks have been tapping the ECB and they are catching a bid. Bond auctions have gone well and Spain is even considering a syndicated offering. As long as interest rates in Europe are stable, credit concerns will be kept in check.

The ECB will release its statement tomorrow. The comments should be positive now that interest rates have pulled back.

China will release its CPI and PPI tonight. If inflation is benign, traders will expect further easing. I still believe economic conditions in China are tenuous and they could be on the brink of a "housing bubble".

Economic releases in the US have been positive. The jobs numbers continue to improve and ISM manufacturing, ISM services and GDP all exceeded estimates.

Earnings season is more than half over and the results were fair. Profits increased in the high single digits Y/Y. This is the worst showing in over two years, but comparisons are harder to beat. The bottom line is that corporations are still growing earnings. Balance sheets are solid and stock violations are attractive at a forward P/E of 14.

European credit concerns have subsided and earnings season is winding down. That means the focus will be on economic releases. I am expecting good domestic numbers, but Europe and China could present a problem.

Any pullback from this level will result in a buying opportunity. Asset Managers don't want to chase, but they will buy dips.

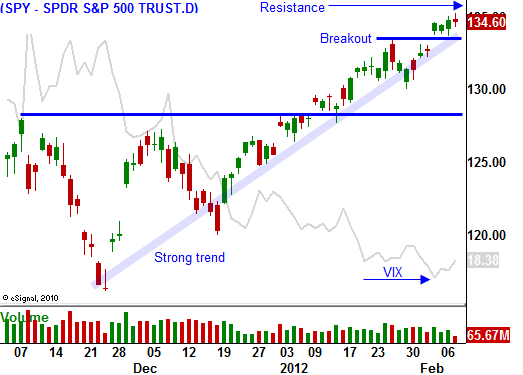

I am long VIX calls and I am buying calls on strong stocks that are breaking out. Like everyone else, I don't want to over commit at this level. The market is up against major resistance and I won't add until we get a breakout or a pullback. The VIX calls will provide a hedge.

The market is testing the downside today. Bears will not be able to get anything going. Asian markets were strong last night and I believe buyers will come in this afternoon. This lackluster price action should last the rest of the week.

I suggest a balanced trading approach with a bullish bias. Buy calls on strong stocks and puts on weak stocks. Your ratio should be 3 to 1. I would also keep your size relatively small since we are in "no man's land". There will be better trading opportunities on a breakout or a pullback. Option premiums are cheap so you should be favoring buying strategies.

Daily Bulletin Continues...