The Next Big Move Is Down – We Are Still A Few Weeks Away. 100-Day MA Will Be Tested

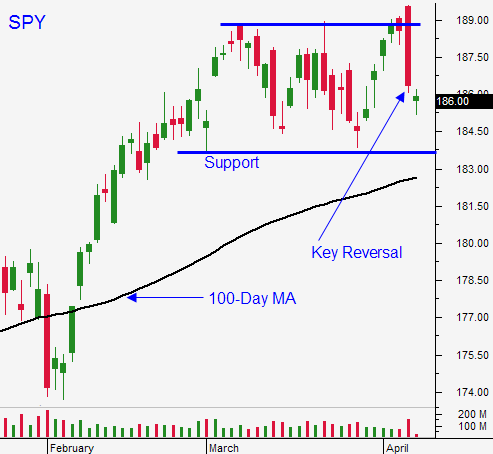

Posted 9:25 AM ET (Pre-Open) - Friday the market surged to a new all-time high after the jobs report and sellers jumped on the opportunity. The selling pressure was heavy and the SPY closed on its low of the day. This is known as a key reversal and it is very bearish.

Yesterday, we saw follow-through selling. In just two days the market covered a two-month range. You know from my comments that I've been very skeptical of this rally. When we made new highs I wanted to monitor the action from the sidelines. Typically, Asset Managers that want to reduce risk will lift offers and they will let the market run so that they can fetch higher prices.

The selling started right at the opening bell and it has not subsided in the last two trading days. This is a very bearish sign and it tells me that the smart money is in "risk off" mode.

The first warning sign came from the bond market. The Fed has been steadfast in its tapering program and yields would typically be moving higher. When they started to decline I suspected a flight to safety.

In the last two months I've outlined a dozen issues that the market has been able to shrug off. Every news story got a positive spin.

I'm convinced that the next big move is down. However, five-year bull markets die hard. When we finally roll over, we can expect swift declines and nasty short covering rallies.

This is still a low probability trading environment and I don't want to jump into this meat grinder. This is "turnaround Tuesday" and it is typical to see a contract trend move. After two days of heavy selling, we should see a bounce today.

Alcoa will post earnings after the close, but I'm not expecting much of a market impact. JPM and WFC will be much more important on Friday. The big wave of releases is still two weeks away.

The FOMC minutes will be released tomorrow and their commitment to tapering could weigh on the market.

China's trade balance will be released Wednesday evening and it will spook investors. Their economy continues to slip and their fiscal spending programs will not spark activity for a few months.

Retail sales will be posted Thursday morning. In theory, the polar vortex should have resulted in pent-up demand. Temperatures have been on the rise and we will see if consumers opened their wallets.

I'm expecting another wave of selling this week. We are only one bad day away from the 100-Day MA (182.60). That support will hold and the market will rebound as earning season unfolds. The "darlings" (FB, GOOG, AAPL...) will spark a small round of buying and we will drift back into the middle of the trading range. Once that rally runs out of steam, we will be poised for a correction. We will not get close to challenging $189 (lower high)

The closer we get to May, the bigger the threat. During the last three years, the 100-day moving average has represented a great buying opportunity. This time it will be breached and the market won't be able to rebound. That will flush out every bullish investor that has leaned on that support level.

My forecast has a technical bias. The price action I'm seeing is very bearish. Resistance is building and sellers were quick to slap down this latest rally. We are overdue for a 10% correction.

There are fundamental issues, but nothing glaring. Stock valuations are little rich, but they are not outrageous. If economic conditions improve, companies will make money hand over fist.

Global debt levels are extreme and credit concerns have plagued us for years. It's almost impossible to predict a credit crisis, but something is brewing. China and Japan could be the source.

From an investment standpoint, reduce risk. I like to keep it simple so I prefer to raise cash by selling stock vs. hedging. Option implied volatilities are still cheap. If you prefer to hedge - buy some put protection.

From a one month trading standpoint, it is too early to get short. Stocks typically rally into earnings season. The expectations are low and we could see a small pop. Once that runs out of steam, you can take short positions.

From a one-week trading horizon, I believe we will see more selling. I plan to day trade from the short side.

The market is likely to probe for support early today. Once the low is established, I believe we will rebound. Let this move exhaust itself and buy a few puts. Tomorrow and the rest of the week bears should return. Given the heavy selling the last two days, this is the most likely scenario.

If the market rallies early in the day, we could see a nasty reversal. Sellers are anxious and once the move stalls, they will start hitting bids. When the downward momentum has been established, stocks will continue to drift lower and we could hit an air pocket. The 100-day moving average could be tested. This is a less likely scenario today, but it will set up a nice short if it happens.

My comments are lengthy today so let’s recap.

#1 - Reduce risk in your investment portfolio (sell stock).

#2 - Keep your size small. We are still in a low probability trading environment.

#3 - Look for short-term weakness and an earnings bounce.

#4 - The next big move is down and it's a few weeks away.

.

.

Daily Bulletin Continues...