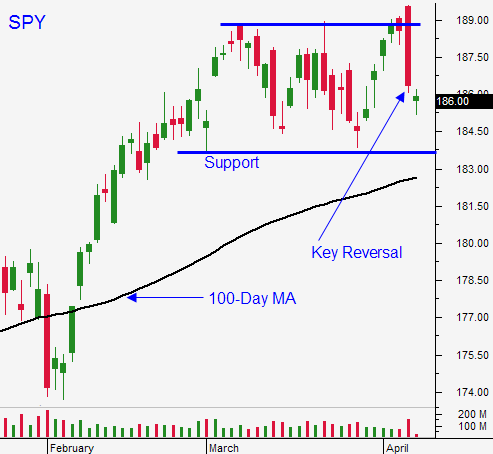

Resistance Is Building – Stay In Cash Until SPY is Below $184 or Above $189

Last Friday, the market surged to a new all-time high after the jobs report. In March, 191,000 jobs were created. The initial reaction was positive, but sellers quickly stepped in. Stocks retreated the entire day and we finished on the low. This price action is known as a key reversal and it is bearish.

I have been mentioning for weeks that I do not trust this rally. In my comments from Friday I mentioned that I want to monitor the selling pressure from the sidelines. Many Asset Managers have been reducing risk and I wanted to see how long they would wait before they started hitting bids. It didn't take long.

This is a choppy, low probability trading environment. The best thing you can do is to stay on the sidelines until we trade below SPY $184 or above $189. I have lowered my entry point for put positions and I will use the low from March 27th. I've been head faked enough in the last month and I won't pull the trigger until I'm convinced that we have a breakdown.

China is the biggest concern. Conditions are slowing and new government spending programs are keeping hope alive. This stimulus will take months to bear fruit and activity levels will continue to decline. Traders will wonder if it is "too little too late". Credit conditions will worsen and new defaults are likely. On Thursday China will release its trade balance.

Japan raised it sales-tax from 5% to 8% last week. Their economy is struggling and it could be even worse than it looks. Consumers probably bought goods ahead of the tax hike and sales were pushed forward.

Emerging market credit risks is rising (Brazil, Argentina and Turkey) and it can escalate at any moment.

In the US, bad weather has been blamed for the economic slowdown. Temperatures are rising and traders want to see improvement. ISM manufacturing, Chicago PMI, ADP, ISM services and the jobs report all came in light.

This Thursday, retail sales will be posted for the month of March. If purchases did not increase, the pent-up demand theory will be questioned.

Alcoa will kick-off earnings season tomorrow, but it won't have much of an impact. JP Morgan and Wells Fargo will post on Friday and they could set the tone for the banking sector. The big releases are still two weeks away.

Profits are expected to be flat year-over-year and revenues will only increase 3%. Stocks are trading at a forward P/E of 16 and they are not cheap.

Bond yields are declining as the Fed continues its tapering program. This is counter-intuitive and it suggests a flight to quality.

We could see one more push higher as earnings season begins. Resistance will build as we get closer to May.

As long as we are between SPY $184 and $189, keep your powder dry. I will day trade intraday momentum, but I will not be taking overnight positions.

The market will probe for support early this morning. If the market makes a new intraday low after a few hours of trading, we will drift lower this afternoon.

The most likely scenario is choppy two-sided price action.

.

.

Daily Bulletin Continues...