Earnings Season Will Attract Buyers – But Resistance Is Heavy. Reduce Risk During Rally

Posted 9:15 AM ET - Yesterday, "Turnaround Tuesday" produced a nice rebound after two days of heavy selling. That rally is continuing this morning and global markets had a positive overnight session.

This afternoon the FOMC minutes will be released. It will reveal a tapering consensus among committee members and the market won't like the reminder. I'm not expecting a big reaction, but it should keep a lid on this bounce.

China will release its trade balance tonight. Conditions continue to slip and the number should be light. Traders are focused on upcoming fiscal spending programs and a weak number will test their conviction. It will take a few months for the fiscal spending programs to bear fruit. As activity continues to decline, some will question if it is "too little too late".

Tomorrow, retailers will post same-store sales. BBBY, FDO and PIR will release earnings. Many analysts believe that the polar vortex has resulted in pent-up demand. If we don't see a "pop" in sales, this theory will be questioned.

Alcoa kicked off earnings season and the reaction was decent. Cost-cutting helped the bottom line and aerospace helped the top line. Wells Fargo and JP Morgan will post results on Friday and they will set the tone for the financial sector.

I believe we will see one more push lower before earning season. That move could start this afternoon and conclude Monday. This is a low probability trading environment – don’t get short ahead of earnings season. I will be day trading and I will be selling some out of the money put credit spreads on stocks that have been badly beaten down.

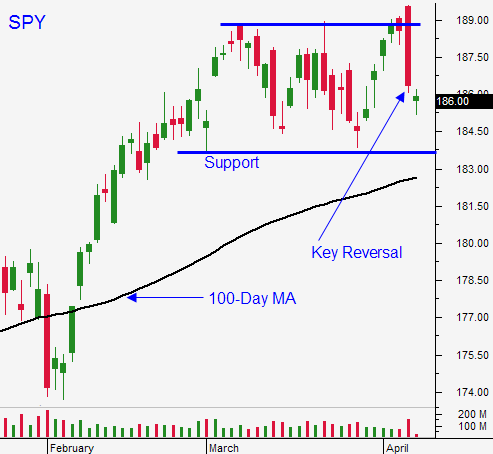

The strongest companies announce early in the earning cycle and I'm expecting a decent reaction. The market should be able to grind back, but resistance is heavy at the all-time high.

As we get closer to May, the selling pressure will build. We've seen a rotation into bonds and that suggests a flight to safety. Each time the market has tried to break through resistance, profit-taking sets in and stocks retreat immediately.

A strong economic rebound (job growth in excess of 250,000) would prevent a serious correction in May. Economic releases have been given a free pass and time will tell if this soft patch was weather related. I am relying more on my technical observations and they suggest that activity is still sluggish.

Look for a nice rally this morning and some selling later in the day. China's trade balance will weigh on the market overnight. If retail sales are flat, the market will test support at $184.

Sell some out of the money put spreads and distance yourself from the action. Keep your size small.

.

.

Daily Bulletin Continues...