Get Ready For An Earnings Bounce – The Big Move Will Come When It Runs Out of Gas

Yesterday, the market started the week off on a positive note. Stocks surged higher and they ran out of steam in the middle of the day. Sellers probed for support and the low from Friday was tested. That level held and we saw a healthy bounce into the close.

I mentioned yesterday that we would test Friday's low one more time. If you were long puts, I hope you took advantage of the opportunity. Shorts will be treading on very thin ice the rest of the week.

The S&P futures are in positive territory this morning and we should grind higher today. Empire Manufacturing was much weaker than expected. The NAHB index (housing) was in line, but it did not pop as many expected. Economic releases will take a backseat to earnings announcements.

Intel will post results after the close. Their enterprise and mobile segments should produce good results. The stock is been able to move higher in a weak market and good news might already be priced in.

China will post GDP, retail sales and industrial production tonight. The numbers will be weak and we will see some overnight selling. I am not expecting a sustained move. Traders are still willing to focus on fiscal spending programs and they will give this round of bad news a free pass.

Google, IBM and SanDisk announce after the close Wednesday. A number of companies will post results Thursday morning and the group looks solid. These announcements will produce a nice relief rally and the SPY should close above $184 this week.

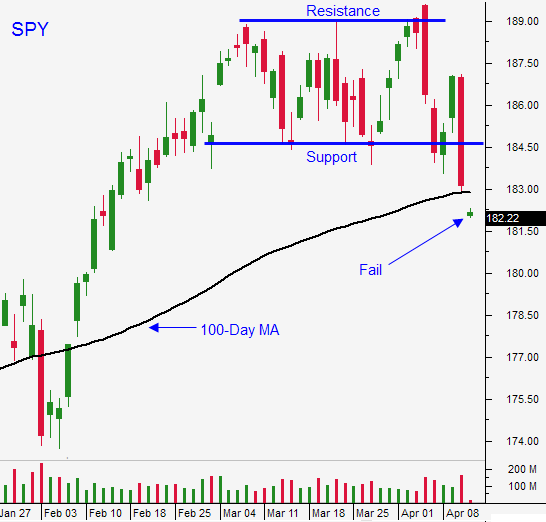

Here is how I see the week playing out. We will rally to SPY $184 today and the market will stall. Overnight news will spook investors and we will probe for support early tomorrow. The 100-day moving average will hold and stocks will grind higher Wednesday afternoon and Thursday (the market is closed Friday).

The strongest companies announce early in the earnings cycle and optimism will build. I do not believe we will challenge the all-time high ($189). By the end of April, we will see the earnings rally run out of steam. This will set up an excellent shorting opportunity and I plan to trade it aggressively.

In the last few weeks I have seen heavy selling. The market will make a lower high and once we roll over, the 100-day moving average will be taken out with ease. Soon after, the 200-day moving average will be tested.

China's growth is slipping, Japan just increased it sales-tax by 50%, US growth still appears sluggish (no signs of pent-up demand), profit growth will be flat this quarter, forward P/E's are fairly rich, the Fed continues to taper, tensions in the Ukraine are building and emerging market credit concerns can escalate at any moment. All of these influences are weighing on the market.

Active traders can buy a few calls this week. Maintain tight stops and set targets. Know that the rug can get pulled out from under you at any time.

If you are a swing trader, I suggest waiting for the earnings rally to stall. Don't try to get cute with this little bounce and keep your eye on the prize. The better move will come in a week or two.

.

.

Daily Bulletin Continues...