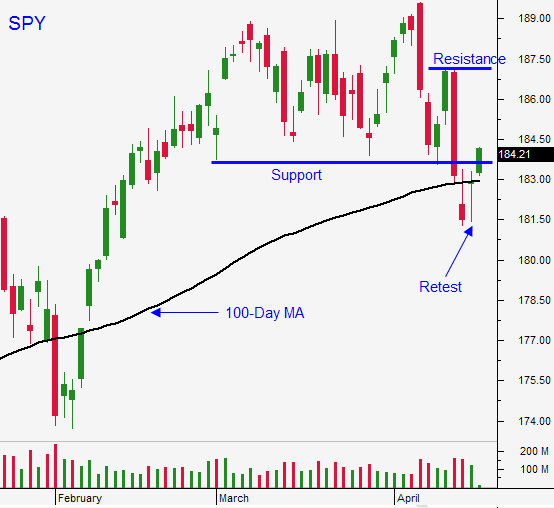

The Earnings Rally Has Started – SPY Is Back Above the 100-Day MA. Tread Carefully

Posted 9:30 AM ET (Market Open) - Shorts, I warned you Monday and I warned you again yesterday. I hope you covered your positions. The market tested the low from Friday one last time and it rebounded sharply. Stocks closed above the 100-day moving average and the earnings rally is underway.

Intel posted good results and strength from the PC and tablet segments fueled profits. Yahoo also posted good results and the stock is up after earnings. Google, IBM and SanDisk report after the close and we have a solid group of companies on deck before the open tomorrow.

The market should be able to rally into Easter. SPY $184 provided some resistance yesterday and my next target is $186.50. The strongest companies post early in the earnings cycle and the price action should be bullish for the next week or two.

I am hoping we challenge the all-time high because that would set up an excellent shorting opportunity. I still believe the next big move is down.

When we tested support yesterday I bought more calls. My position is relatively small and I still don't trust this rally. I will ride the wave and I will monitor the selling pressure very closely. Make sure to maintain stops and set targets.

Longer-term traders should wait for this rally to exhausts itself. The better move will come on the backside.

China's GDP came in at 7.4% and that was better than feared. Keep in mind that it was an 18-month low. Industrial production was a bit light and retail sales were in line. Traders are still focused on fiscal stimulus and they are willing to give soft numbers a free pass. The flash PMI's next week will be important. Reuters reported that defaults on inter-company loans in China are on the rise and I sense that trouble is brewing.

Housing starts were little shy of expectations this morning and Empire Manufacturing was worse than expected yesterday. Retail sales did not show the "pop" analysts were looking for and the pent-up demand theory will be questioned.

Janet Yellen will speak at 12:15 PM Eastern time. I'm not expecting any surprises. The Beige Book will be released at 1:00 PM Eastern time and it will show sluggish growth with some signs of life. It should be market neutral.

Stocks are rebounding from an oversold condition and earnings season will fuel the bounce. Every time the 100-day moving average has been breached, it has set up an excellent buying opportunity. Bullish speculators will pile back in now that we are above it.

Profits will be lackluster this quarter and the rally won't pack much of a punch.

Asset Managers have been reducing risk. They are rotating out of equities and into bonds.

We've seen heavy selling at the all-time high. If profit-taking sets in before we challenged the high it will be a sign that sellers are very aggressive. A lower high will indicate that the market is ready to roll over.

We should still see a week or two of positive price action. Keep your size small and maintain your stops.

I hope we challenge the all-time high because it will set up an excellent shorting opportunity.

The market will rally out of the gate today and we will probe for support. The dip will be shallow and brief and active traders can buy it. The market will recover and grind higher into the close.

.

.

Daily Bulletin Continues...