Support Will Be Tested Once More This Week – Earnings Bounce Starts Thursday

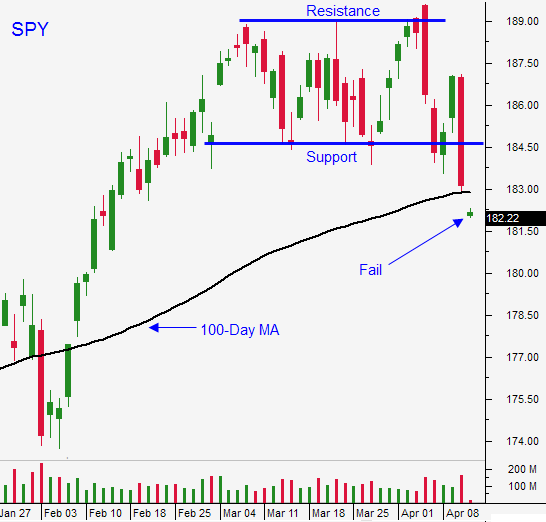

Posted 9:15 AM ET (Pre-Open) - Last week, the market finally cracked. The SPY breached the 100-day moving average and the selling accelerated into the close on Friday. I have little doubt the next big move will be down.

This is still a low probability trading environment. Five-year bull markets die hard and you need to keep your size small for a little while longer.

Stocks will try to rally this morning, but we will probe for support one more time this week. Intel posts results Tuesday after the close and they should be good. Enterprise and mobile will provide nice growth.

Tuesday evening, China will post GDP, industrial production and retail sales. The results will be dismal and the market won't like the news. We are likely to test the lows from Friday (181.30). Support will hold and the market will stage and earnings rally.

Google, IBM and SanDisk will post results after the close Wednesday. The earnings reports Thursday morning will be fairly heavy and the group looks very solid. The market will rebound and we will finish the week on a positive note (Friday is an exchange holiday).

This last wave of selling pushed the market below the 100-day moving average. Bullish speculators were flushed out and bearish speculators got short. The strongest companies announce early in the earning cycle and the market will bounce next week. Shorts will run for cover and bullish speculators will pile back in.

In the last two years every breach of the 100-day moving average has been an excellent buying opportunity. Traders will get long on the notion that we will sling shot to a new relative high. Unfortunately, this time will be different.

The selling pressure the last few weeks has been very heavy. Asset Managers are reducing risk and the market will not get close to the all-time high. We might make it back to SPY $186. The next wave of selling will come very quickly and we will break the 100-day moving average. Stocks will make a lower high and technically it will become apparent that we are rolling over. This is the move that we will be able to sink our teeth into.

When the 100-day moving average fails the second time, the 200-day moving average will be tested. The market is overdue for a correction and the table is set for a nasty decline in May.

China's fiscal spending won't bear fruit for a few months and conditions will continue to deteriorate. Traders will wonder if the fiscal stimulus will be enough to stop the slide. Japan hiked sales taxes by 50% and that will reduce consumption. Credit conditions in emerging markets (Brazil, Argentina and Turkey) are tenuous. Tensions in the Ukraine continue to build.

US activity has been sluggish and analysts are projecting a surge in consumption. In theory, the polar vortex has resulted in pent-up demand. Retail sales were posted this morning and they increased 1.1%. They were only up .7% ex-autos. This does not keep pace with inflation and it is not the "pop" they were projecting.

Corporate profits will be flat and revenues are expected to increase 3%. These results will not excite investors when stocks are trading at a forward P/E of 16. We've seen a rotation into bonds during monetary tightening and this indicates a flight to safety.

If you are long puts, be prepared to take a little heat this morning. You will have a better exit point. The selling pressure the last two weeks has been heavy and the downside will be tested one more time. Use any dip as an opportunity to take profits.

When support is established after the next decline, I will sell out of the money put credit spreads in May. I want to distance myself from the action and I will buy them back before expiration. I might buy a few calls on beaten down tech stocks. This strategy should only be used by active traders. Conditions can change very quickly and you need to maintain stops and set targets.

The better trade will come in two weeks when the earnings bounce stalls. That will be your chance to spread your wings and increase your size. I am still expecting a correction in May and I will be buying puts.

To recap, look for one more push lower this week and a nice bounce into Easter. Earnings season should attract buyers and the market will snap back. It could get as high as SPY $186 before it hits resistance. I don't believe we will challenge the all-time high. Once that move runs out of steam, prepare to get short.

Keep your size small for a little while longer.

.

.

Daily Bulletin Continues...