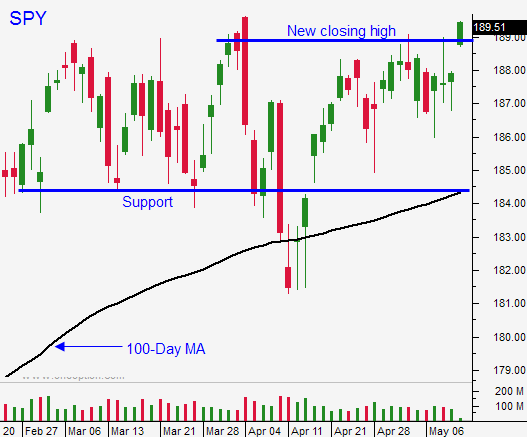

Market Slipped Back Into the Trading Range – No Drivers Either Way – Doldrums Ahead

Posted 9:40 AM ET (Market Open) - Monday the market broke out to a new high and it stalled. Profit-taking Tuesday and Wednesday pushed us right back into the trading range. The news is light and pre-holiday trading will suck the life of the market next week.

Flash PMI's will be released Wednesday and the results should be in line with expectations. Activity across the globe is sluggish, but stable.

The FOMC minutes on Wednesday will be benign. Yellen has been speaking and we know what to expect. The Fed will continue to taper and they will leave room to pause if economic conditions deteriorate. The next FOMC meeting is scheduled late in June.

Initial jobless claims fell below 300,000 today and Empire Manufacturing was better than expected. The market did not have much of a reaction to either release.

Earnings season is winding down. Retail sales declined .1% this week (ex-autos and gas) and that is consistent with dismal earnings announcements from the sector this week. I am not seeing any signs of pent-up consumer demand.

Unfortunately, we could be trapped in a tight trading range for the next month. Buyers and sellers have been paired off this year.

Interest rates are near historic lows and yields are barely keeping pace with inflation. Corporate profits are flat and revenue growth is just above the inflation rate. At a forward P/E of 16, stocks are fully priced.

Asset Managers are waiting for signs of economic improvement. No one feels like they will miss the next big rally and the level of conviction is low.

China has been the global growth engine for the last decade. I believe it will determine the next big move. If conditions improve, global markets will rally. If they deteriorate and shadow banking credit concerns emerge, the market will correct. Until something happens in China, we are in a holding pattern.

I suggest selling out of the money put credit spreads on stocks that have posted good earnings. Make sure there is strong support between the stock price and the short strike. If the stock breaks support, buy back the put spread. This strategy will help you generate income and you can distance yourself from the action.

I am day trading and I will sell a few out of the money put spreads this week. My positions will be small until conditions improve.

Look for dull trading between SPY $183 - $189 the rest of the month.

.

.

Daily Bulletin Continues...