Market Needs To Rally Today To Keep Us From Falling Back Into the Trading Range

Posted 10:20 AM ET - The market made a new high on Monday, but it was not able to push higher yesterday. There was a small rally early in the day and the excitement fizzled out quickly. Stocks fell into a very narrow trading range and it feels like we are in pre-holiday mode.

The economic news is light. Flash PMI's will be released in a week. We won't get the jobs report until June 6th and the next FOMC meeting is on June 26th. Throw in the Memorial Day holiday and activity could really grind to a halt.

Earnings season is winding down and we won't have that catalyst. Profits were relatively flat and revenues barely rose above the inflation rate.

Economic conditions in the US, Europe and China are sluggish.

Retailers will post results in coming days and I doubt we will see any signs of pent-up demand. The retail sales number came in at -.1% (ex-autos and gas) yesterday.

The elections in India have pushed their market higher. The results will be known Friday and this could be a sell the news event.

Bond yields are near historic lows and stocks are attractive on a relative basis. Asset Managers are nibbling, but they will not buy aggressively an all-time high. They have adopted a “close your eyes and plug your nose” buying mentality. At a forward P/E of 16, stocks are not cheap.

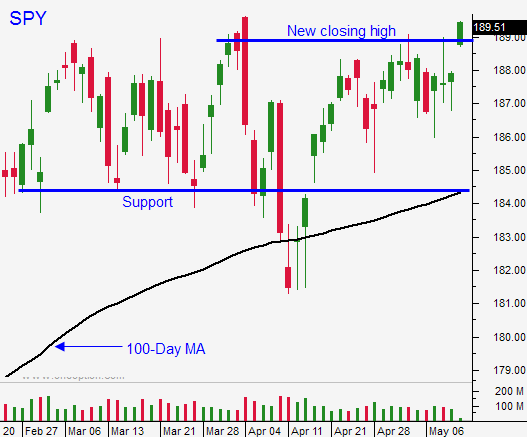

We need a rally this week or we will fall back into the trading range. There is significant call open interest above SPY $190 and we could see a short squeeze if we move above that level.

I am still on the sidelines. I need to see concrete evidence of pent-up demand before I can't embrace this rally.

I will day trade from the long side.

If you decide to buy calls and hold overnight, use SPY $189 as your stop.

If there is going to be a short squeeze, we need to see a rally today. In early trading, it does not feel like we will get one.

.

.

Daily Bulletin Continues...