Market Is Back In the Range. Very Quiet Week Ahead – Sell A Few Put Spreads

Posted 9:00 AM ET (Pre-Open) - This week the market broke out to a new all-time high. The open interest in May out of the money calls was large and there was a chance for a short squeeze. We did not see follow-through buying and the breakout failed. Bullish speculators got flushed out and bears have the ball.

Initial jobless claims fell below 300,000, Empire Manufacturing was better than expected and this morning's housing number exceeded expectations. These numbers should help the market and I believe the bleeding will be relatively contained today.

Earnings season is winding down and the economic releases are very light. The FOMC minutes next week should be benign. We know from "Fed Speak" that tapering will continue and they will leave room to pause. Flash PMI's will be posted on Thursday and they could move the market (either way). Trading volumes will be extremely light ahead of a three-day weekend.

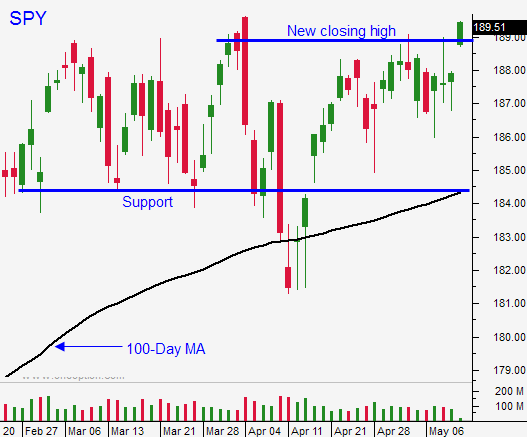

From my viewpoint, there are two drivers that could force the SPY out of this $183 - $189 trading range.

If pent-up demand suddenly emerges, stocks could breakout. This is unlikely. Europe's GDP (ex-Germany) declined and our GDP was only up .1%. Retail sales have been dismal and consumers are cautious.

The second potential driver is China. If conditions continue to deteriorate and shadow banking credit concerns escalate, the market will correct. The PBOC is not going to ease and China will rely solely on fiscal stimulus. This will take months to bear fruit and conditions could continue to slip. Of the two drivers, this is more likely.

Without either of these two events, every market move will be nothing more than a head fake. It will look like the real deal and it will stall.

I am day trading and I will sell a few out of the money put spreads when the market finds support. My positions are small.

The price action is random and volumes are light. May options expire today and we should see a choppy day. Look for an early probe lower. Stocks should be able to find support at $186.75.

Be patient and don't piss your trading capital way in this directionless market.

.

.

Daily Bulletin Continues...