Market Needs Solid Numbers Next Week To Keep The Rally Going

Posted 9:45 AM ET - The market continues to grind higher and the path of least resistance is up. Major economic releases are scheduled next week and they need to reveal pent-up demand.

ISM Manufacturing, ISM services, ADP, official PMI's and the Unemployment Report will be released. We are just coming out of a news vacuum and this is our last "island" of hope. The data needs to fuel us through June. If the results lack punch, the doldrums are likely to set in.

Earnings season won’t start until July and the FOMC does not meet for another month.

The ECB will probably lower rates next week (June 5). This is widely anticipated and it could be a "sell the news event". European stocks have been rallying ahead of the meeting. Savers will have to pay to keep their money in a bank.

Global economic growth is sluggish. Europe is improving, but GDP is expected to grow by a meager 1% this year. China's activity has been slipping this year, but it has temporarily stabilized.

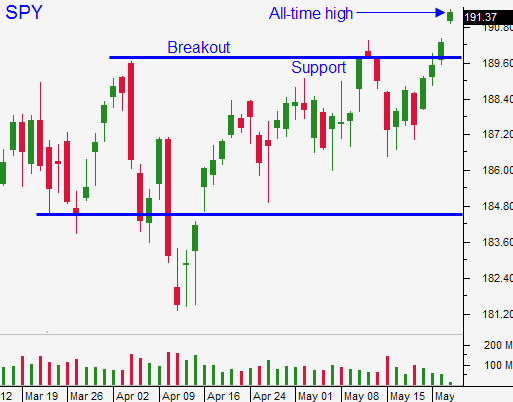

Domestic economic growth is stable, but we are not seeing any signs of pent-up demand. GDP came in at -1% and that was much worse than expected. Initial jobless claims fell below 300,000 and durable goods orders were better-than-expected. The news is mixed and that needs to change next week. We need a solid round of news across the board to fuel this breakout.

Trading volumes have been light and the level of conviction is low. At a forward P/E of 16, stocks are fully priced.

I sold some put spreads last week and they are in nice shape. I don't trust this rally so I am distancing myself from the action. I have also been day trading. I can't embrace this breakout until I have proof that economic conditions are improving.

If you own calls, raise your stop to SPY $191. Keep raising your safety net as the market moves higher.

We all want to avoid the summer doldrums so let's hope we get some good numbers next week.

.

.

Daily Bulletin Continues...