Market Needs Big News This Week or We Will Fall Into the Summer Doldrums

Posted 11:20 AM ET - Last week the market continued to float higher and it made new all-time highs on a daily basis. Momentum favors the bulls and there has not been any news to spoil the rally.

Major economic releases will be posted this week and this "island" of news has to fuel us the rest of the month. ISM manufacturing came in below estimates and that was not the start we needed.

Global economic activity is treading water, but conditions are fragile. Official PMI's were generally in line. Asia was a little better-than-expected and Europe was a little worse than expected.

The ECB will meet on Thursday and a rate cut is widely anticipated. Yields will fall into negative territory and this could be a "sell the news event".

ADP will be released on Wednesday and it was weak relative to the jobs report last month. I trust this number more than I do the jobs report. ADP processes payrolls for small and medium-size businesses and they have their finger on the pulse.

Analysts are projecting 218,000 new jobs for Friday's Unemployment Report. This does not keep pace with the workforce and if we hit the number, I believe the market will decline. Anything south of 250,000 will be disappointing and traders will dismiss the pent-up demand theory.

The market has floated higher and this rally lacks substance. The volume has been light and the level of conviction is low.

Interest rates are near historic lows and money has been flowing into equities due to a lack of investment alternatives. Asset Managers are not going to chase the market at an all-time high, but even a small bid can push stocks higher in a light volume environment. At a forward P/E of 16, stocks are fully priced and there is room for a correction.

I can't fully embrace this rally until I have proof that economic activity is improving. One small round of bad news will flush bullish speculators out.

Earnings season is more than a month away and the FOMC does not meet until June 25th. We need solid news across the board or we will fall into the summer doldrums.

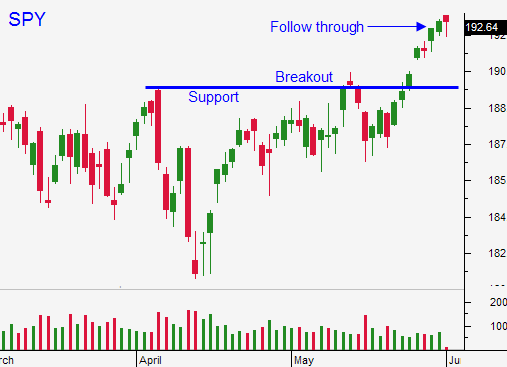

If the news is disappointing, I will buy puts below SPY $191.

You should be long a few calls from last week. Use SPY $192 as your stop - don't let your winners turn into a losers.

Let's hope for big news either way this week.

.

.

Daily Bulletin Continues...