Big Numbers Next Week – Wait For Proof of Pent-up Demand. Call Buyers – Use Stops

Posted 9:45 AM ET - The good news is that we are just about out of this news vacuum. Next week the economic news will pick up. The bad news is that ISM manufacturing/services, ADP and the Unemployment Report will have to fuel us for the entire month of June.

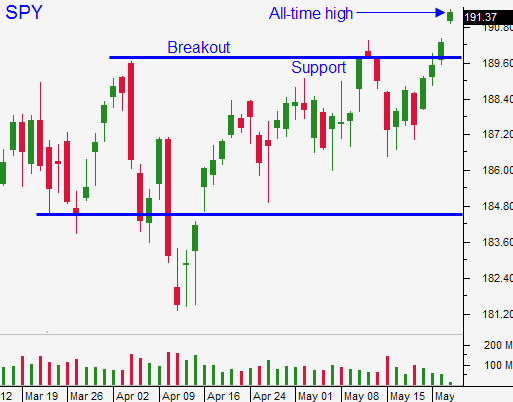

If we do not see signs of pent-up demand, this breakout will not gather strength. Earnings season has ended and Q2 releases won't start until July. The FOMC won't meet until June 25th and the summer doldrums could set in.

Durable goods orders were better-than-expected yesterday and initial claims fell below 300,000 this morning. Unfortunately, GDP came in at -1% and that was worse than expected. So far, the market has discounted the GDP number.

Retailers have been reporting dismal results and the guidance is gloomy. Consumers are cautious and I'm not seeing signs of pent-up demand.

China's flash PMI came in better than expected last week and that has calmed nerves. If economic conditions deteriorate it has the potential to spoil this rally. Investors are hoping that fiscal spending will stabilize growth. I am hearing rumors that the PBOC could lower bank reserve requirements twice in the second half of the year. If the market is going to correct, a slowdown in China will be the cause.

Economic conditions in Europe continue to gradually improve. It's important to note that growth this year is projected to be a meager 1%.

The ECB will meet next week and most analysts believe they will lower rates. This will push interest rates into negative territory and there will be unintended consequences. Imagine having to pay to keep you money at a bank. Easing by the ECB is highly anticipated and it could be a "sell the news" event.

The Fed said that it might extend tapering and it could introduce tightening measures in the near future. In theory, this would provide a smoother transition as we prepare for rate hikes in 2015. Interest rates are at historic lows and they should be moving higher given the news. Asset Managers are still buying bonds and this suggests a flight to safety.

Stocks are fully priced at a forward P/E of 16. Earnings growth is flat and revenue growth is barely keeping pace with inflation. There is room for a correction.

The market is floating higher and the path of least resistance is up. If we see signs of pent-up demand next week the SPY could challenge $200. If not, we could pull back into the range until earning season.

Buy a few calls and use SPY $190 as your stop. Keep your size small.

We all want this breakout to hold so let's hope for some big numbers next week.

.

.

Daily Bulletin Continues...