ADP Will Set the Tone On Wed – We Need A Big Beat Or A Big Miss

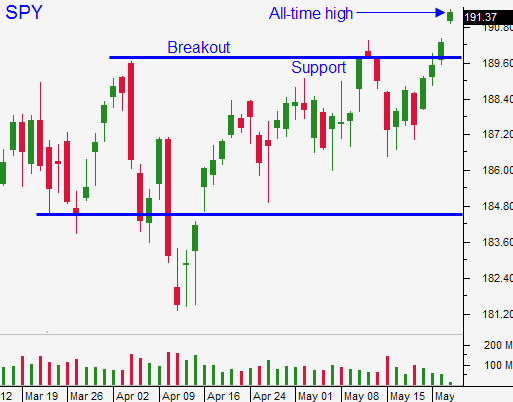

Posted 11:30 AM ET - The market has been making new all-time highs on a daily basis. Asset Managers are not going to chase stocks until they have proof that economic conditions are improving.

Official PMI's were slightly better than expected. China exceeded estimates and Europe missed by a small margin. Conditions are stable, but sluggish.

ISM Manufacturing missed estimates by a wide margin, but there was a calculation error. It was corrected a few hours after the open and it was revised to 56.0. That was much better than expected and it is the number we needed.

The ADP report will set the tone tomorrow. Last month, it was weak relative to the jobs report. On Friday, analysts are expecting 218,000 new jobs. I believe we need 250,000+ to keep this rally going.

The ECB is expected to lower rates on Thursday. The move is widely anticipated and this could be a sell the news event.

The FOMC will not meet until June 25th and earnings season is more than a month away. This is a heavy news week and it needs to fuel us the rest of the month. Sluggish, stable releases will not suffice. If that's what we get, the summer doldrums will set in.

If you took my advice last week, you own a few calls. Raise your stop to SPY $192. Don't let your winners turn into losers.

This rally has come on light volume and the level of conviction is low. Bullish speculators could easily get flushed out and I will by puts if the SPY closes below $191.

Let's hope for a big "beat" or a big "miss" this week.

.

.

Daily Bulletin Continues...