ADP Was Weaker Than Expected – No Signs of Pent-up Demand – Use Stops

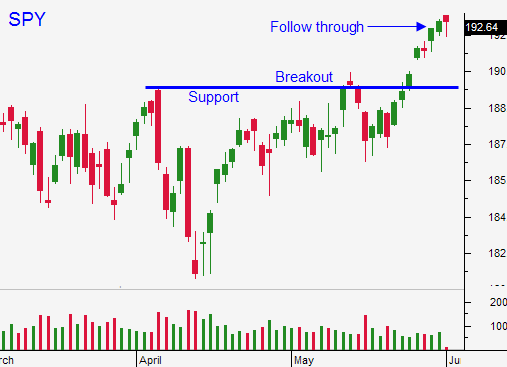

Posted 9:00 AM ET (Pre-Open) - The market broke out to a new all-time high two weeks ago and it has been floating higher on low volume. In the last few days the momentum has slowed and Asset Managers are waiting for major economic releases. This morning we got our first look at employment.

ADP reported that 179,000 new jobs were created during the month of May in the private sector. That was much weaker than expected (200,000) and we are not seeing signs of pent-up demand. I trust ADP more than I do the BLS. The government’s number is filled with seasonal adjustments and labor force participants are removed at will. As we saw before the election, this number can be manipulated. On the other hand, ADP processes payrolls for small and medium-size businesses.

This ADP miss is consistent with the Challenger Gray & Christmas survey last month. Businesses reported that planned layoffs would increase.

Analysts are expecting 218,000 new jobs on Friday. I believe anything south of 250,000 will spark profit-taking. The market has rallied into the jobs report the last three months and we've seen selling after the release. We are set up for that pattern to repeat.

Tomorrow's ECB meeting has “goosed” European stocks. It is widely anticipated that they will cut rates and this could be a "sell the news" event. Interest rates will fall into negative territory and this move could have unintended consequences.

Global growth has been stable, but sluggish. China's activity has been slipping this year, but it is currently treading water. Europe's economy is expected to grow 1% this year and our GDP for Q1 came in at -1%. Economic conditions are fragile.

ISM Manufacturing was revised on Monday and the number met estimates (55.4). ISM Services will be released 30 min. after the open (55.5 expected) and we will get the Beige Book this afternoon.

We just came out of a two-week news vacuum and we are headed back into one. This round of major economic releases needs to fuel the market through June. Earnings season is a month away and the FOMC does not meet until June 25th.

I am long a few calls and my stop is SPY $192. I sense trouble ahead and I plan to exit Thursday if my stop is not hit. I don't want this winner to turn into a loser.

If the market closes below SPY $191, I will buy puts. This rally feels very "fluffy" and the level of conviction is low. Asset Managers will not chase stocks at an all-time high. Forward P/E's are rich (16) and economic growth is tenuous. Bullish speculators could easily get flushed out.

Stay long, be small and use stops. If the breakout fails, be prepared to buy puts.

Let's hope for some big news either way. The worst-case scenario would be mixed results. That would send us into the summer doldrums for the rest of the month.

.

.

Daily Bulletin Continues...