ECB Rate Cut Was Baked In. Jobs Report Pattern Set To Repeat – Take Profits

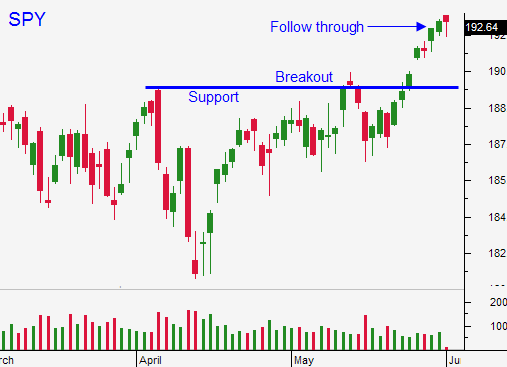

Posted 10:00 AM ET - Last week the market broke out to a new all-time high and it continued to float higher on light volume. The momentum is slowing down and Asset Managers are evaluating major economic releases. This round of news has to fuel the market the rest of the month or we will fall into the summer doldrums.

ISM manufacturing and ISM services were better-than-expected. Both numbers were healthy. ADP reported that 179,000 new jobs were created in the private sector during the month of May. That was below estimates and it bodes poorly for tomorrow's Unemployment Report. Initial jobless claims inched higher this week as well.

Analysts are expecting to see 218,000 new jobs in tomorrow's report. I believe we need at least 250,000 new jobs to fuel this breakout. We need at least 300,000 new jobs to keep up with the labor force.

Much of the recent rally is based on the theory of pent-up demand and we are not seeing it. In the last three months, stocks have rallied into the jobs report and they have declined after the release. I believe this pattern will repeat itself.

This morning, the ECB cut interest rates and it added stimulus. The news was already baked in and the reaction has been muted.

Global economic conditions are sluggish. China's growth has been slipping and the bleeding has stopped for now. Europe's GDP is expected to grow a meager 1% this year and last week we learned that Q1 GDP in the US fell by 1%. Economic conditions are fragile.

Asset Managers will not chase stocks at an all-time high in this economic environment. Stocks are trading at a forward P/E of 16 and there is room for a correction.

We just came out of a news vacuum this week and we will head back into one next week. The next FOMC meeting is three weeks away and earnings season won't start for another month. We needed a big week of news and I don't think we will get it. This mixed bag of news will not do the trick.

I am long calls and I will exit my positions today. I believe we are set up for a speed bump and the market will pullback and test the breakout. Bullish speculators need to get flushed out.

Raise your stops on call positions.

If we do hit a speed bump, I will wait for support and I will buy the dip. The path of least resistance is up.

Error on the side of caution in this light volume environment.

.

.

Daily Bulletin Continues...