Jobs Report Estimates Were Spot On – Summer Doldrums Ahead

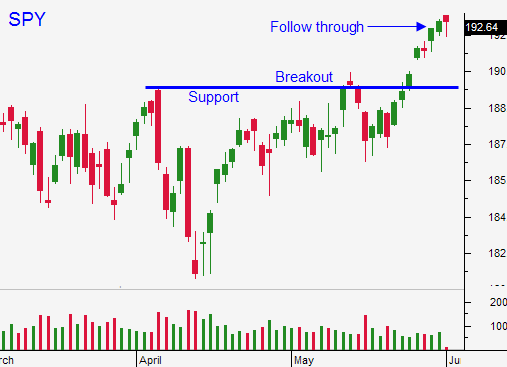

Posted 10:30 AM ET - Yesterday, the market pushed higher after the ECB rate cut. Investors love easy money and the breakout is gaining traction.

This morning we learned that 217,000 new jobs were created in May. The estimates were spot on and that could spell trouble for two reasons.

1. We need 300,000 new jobs to keep up with the labor force. This is a soft number and we are not seeing signs of pent-up demand.

2. We needed a big miss or a big beat. The Unemployment Report is the last piece of big news for weeks and the summer doldrums lie ahead.

ISM services and ISM manufacturing were good this week. They were right in line with estimates. ADP was a little light and initial claims inched higher. A mixed bag of economic releases will keep a small bid to the market. The FOMC meeting is three weeks away and earnings season is more than a month away. Get ready for another news vacuum.

Interest rates are near historic lows and some money is flowing into equities due to a lack of attractive investment alternatives. A small bid can push stocks higher in a light volume environment. Asset Managers are not going to chase stocks at an all-time high when economic conditions are tenuous and when stocks are trading at a robust forward P/E of 16.

If we get a small dip, buyers will step in. If the market gets ahead of itself, we will see some profit-taking. Buyers and sellers are paired off and the market is likely to fall into a tight trading range.

I sold my calls yesterday and I locked-in profits. I will day trade today, but I will not take overnight positions ahead of the weekend. If this rally holds up, I might buy a few calls on Monday.

Protect your profits and raise your stop to SPY $194.

I hope I'm wrong, but we might be in for very quiet trading the rest of the month.

.

.

Daily Bulletin Continues...