News Over the Weekend Was Good – Nothing To Stand In the Way of the Rally

Posted 11:30 AM ET - Last week's economic releases have to fuel this rally the rest of the month. The next FOMC meeting is on June 25th and earnings season doesn't start until July. There is not much to stand in the way of this rally and we are headed into another news vacuum.

ISM manufacturing and ISM services were good. The numbers were in line with expectations and growth remains sluggish. ADP was light and the jobs report was spot on (217,000). Traders liked the numbers, but they did not pack much of a punch. We need 300,000 new jobs just to keep up with the labor force.

We are not seeing pent-up demand. Consumers remain cautious and retailers were not very optimistic about Q2.

China posted better-than-expected trade numbers and exports rose 7%. Japan's GDP rose more than expected and the IMF said that it underestimated growth in the UK. These are all market friendly releases.

Growth in China has stabilized after slipping most of the year. GDP in the EU is expected to grow 1% this year. Q1 GDP in the US fell by 1%. Global conditions are stable, but sluggish.

Bond yields are at historical lows and some money is flowing into equities due to a lack of investment alternatives. Even a small bid in a light volume environment can push stocks higher.

Asset Managers are not going to chase this rally when economic conditions are tenuous. Stocks are trading at a forward P/E of 16 and they are not cheap. Revenue growth is barely keeping up with inflation and profit growth is flat.

This is a very quiet news week and there are not any spoilers. Stocks are likely to drift higher.

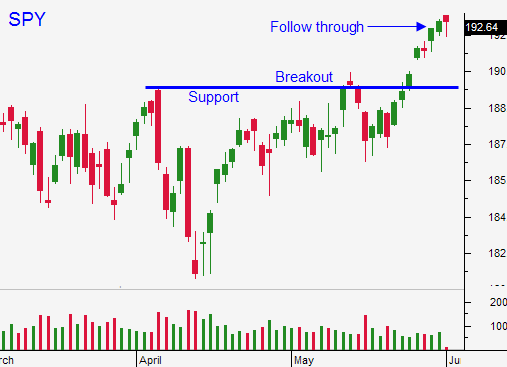

I will buy a few calls this week, but I will keep my size small. Use SPY $194 as your stop.

I don't trust this rally so I will focus on day trading.

Stay long, stay small and raise your stops.

.

.

Daily Bulletin Continues...