FOMC Meeting On Wed Will Be the Focal Point. Quad Witching Could Add Volatility

Posted 9:45 AM ET - Last week, the upward momentum stopped. Stocks are taking a breather and the FOMC meeting on Wednesday will be the focal point.

We're hearing rumors that the Fed might extend the tapering timeline. New tightening measures would be introduced along the way. When the market first caught wind of this news a month ago, it rallied. We might find out the details about this on Wednesday.

The Fed is worried that when tapering ends, the focus will immediately shift to rate hikes. They don't want any shocks to the system and they believe this new approach will provide a smooth transition. From my perspective, tightening is tightening.

Next Monday, flash PMI's will be released. China's industrial production and retail sales were good last week and the news should be market friendly. The US and EU are sluggish.

This is a quadruple witch and we should see a couple of volatile days. Given the FOMC, I believe Wednesday and Thursday set up for active trading.

The economic news has been mixed. Retail sales and initial claims were disappointing last week, but Empire Manufacturing was better than expected this morning. Economic activity is sluggish around the world and Asset Managers are waiting for signs of improvement.

Interest rates are at historic lows and money is dripping into equities due to a lack of attractive investment alternatives. Stocks are trading at a forward P/E of 16 and they are not cheap.

If the market pulls back, buyers will step in. If the market gets ahead of itself, we will see profit-taking. We are in the summer doldrums and I expect to see tight trading ranges.

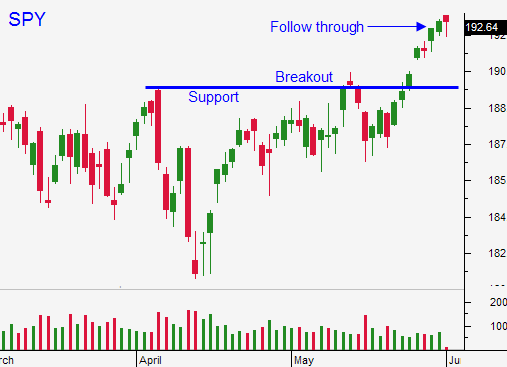

I am day trading. I can't embrace this rally unless we get a pullback. If we test the breakout at SPY $190, I will sell put credit spreads and I will buy some calls.

I sense that the market wants to push higher, but I don’t want to force trades in this low probability trading environment.

If you decide to buy calls this week, keep your size small and use stops.

.

.

Daily Bulletin Continues...