FOMC, Iraq and Quadruple Witching Could Spark Some Action. Let’s Hope For A Dip

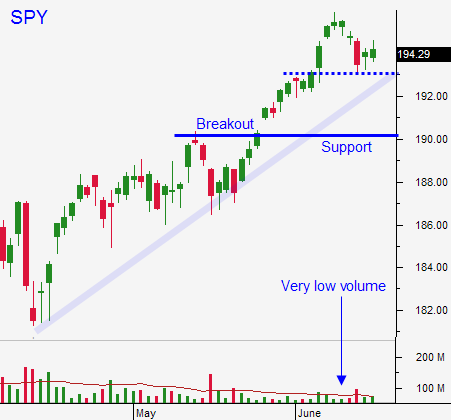

Posted 9:55 AM ET - Last week, the market finally hit resistance and the upward momentum stalled. Trading volumes are extremely light and so are the news releases. That will change tomorrow.

The FOMC will release its statement and it will be the focal point this week. A month ago, the Fed hinted that they might introduce tightening measures before tapering has ended. They also suggested that tapering might be extended. The reaction was market friendly.

Fed officials fear that once tapering ends, the focus will immediately shift to rate hikes. They want to avoid any "shock" to the financial markets and they feel this approach will provide a smoother transition. Some of the details for this plan might be revealed tomorrow.

Economic releases have been mixed. May's jobs number (+217 K) did little to excite investors. We need +300 K to keep up with the labor force. Retail sales increased .1% (ex-autos) and that does not keep pace with inflation. ISM manufacturing/ISM services and Empire Manufacturing were slightly better-than-expected. We are not seeing signs of pent-up demand and economic growth is sluggish.

Last week China posted decent numbers (IP and retail sales). That bodes well for Monday's flash PMI. As long as China's economic growth is stable, the market will be able to tread water.

Corporate revenue growth was up 3% in Q1 and that barely keeps pace with inflation. Profits were flat and the guidance was cautious. At a forward P/E of 16, stocks are not cheap.

Interest rates are at historical lows and some money is dripping into equities due to a lack of attractive investment alternatives. Even a small bid in this light volume market can push stocks higher.

This is a quadruple witch and we are likely to see a couple of volatile days of trading. I believe the FOMC statement will spark some action and it will flow into Thursday.

Oil prices are moving higher due to the conflict in Iraq. If this leads to a small decline, bullish speculators will get flushed out and we could test the breakout (SPY $190). If this happens I will sell out of the money put credit spreads.

The market is in "no man's land" and it could swing either way. I am day trading. I can't embrace this rally until I have proof that economic conditions are improving.

Let's hope that Iraq, the FOMC statement and quadruple witching lead to a selloff. If the breakout is tested, that will present a nice buying opportunity.

If we don't get a pullback, I will continue to day trade.

We are in the summer doldrums. Don't force trades in this light volume environment.

.

.

Daily Bulletin Continues...