Look For A Tight Trading Range Next Week – Cash Is King

Posted 9:30 AM ET (Market Open) - Yesterday, a combination of news events sparked profit-taking. Eric Cantor's primary loss, unrest in Iraq, soft retail sales and a pop in initial jobless claims weighed on the market.

Once the early momentum was established, the market drifted lower. Bullish speculators were flushed out of positions and some of the "fluff" came out of stocks.

China's industrial production and retail sales were in line. Economic conditions have stabilized and this is bullish news.

We are in a news vacuum and the next big release is on June 23rd. Flash PMI's could move the market. Later that week the FOMC will release its statement (June 25th).

There are not any major releases scheduled next week. Quadruple witching could add a little volatility, but trading volumes are very low and these moves are nothing but "noise".

Bonds are at historic lows and money is dripping into equities due to a lack of attractive investment alternatives. Stocks are trading at a forward P/E of 16 and they are not cheap. Asset Managers will buy dips and some will take profits on rips. We should see a tight trading range next week with one volatile day (expiration related).

I am day trading and I caught the decline yesterday.

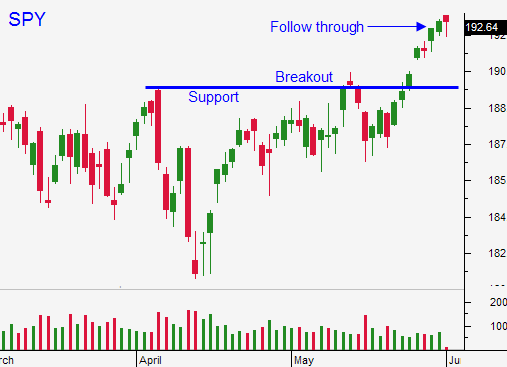

If the market does pullback and test the breakout (SPY $190), I will sell out of the money put credit spreads. I believe that support level will hold.

You should have sold your call positions yesterday.

Cash is King – stay sidelined next week.

Look for a boring day with an upward bias.

Happy Father's Day

Daily Bulletin Continues...