China’s Flash PMI Was Better Than Expected – Look For A Slight Upward Bias This Week

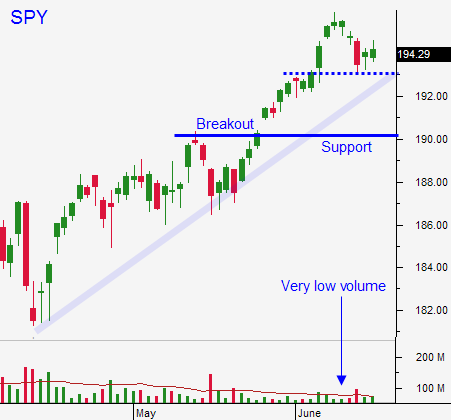

Posted 10:15 AM ET - Last week, the market staged one nice move. The rest of the week was very quiet and the trading ranges were tight. We're in the summer doldrums and we can expect similar trading patterns this week.

On Wednesday, the FOMC did not outline new tightening measures. Traders saw this as “dovish” and stocks surged to a new high. Once the upward momentum was established, quadruple witching fueled the move. We did not get any follow-through buying on Thursday or Friday.

The Fed continued to taper and they lowered economic forecasts (lowered GDP and an increased the unemployment rate). This combination would normally result in a market decline. The Fed knows it is behind the curve and it has to keep tightening. QE has been ineffective and inflation is starting to rear its head.

Flash PMI's were released this morning and they were decent. China's numbers were better-than-expected and I believe it is the key to this rally. As long as economic growth remains stable, stocks will be able to grind higher. The flash PMI's in Europe were a little light.

Existing home sales were released this morning and they were better-than-expected (4.9%)

We will get major economic releases next week. ADP will be released on Wednesday and the Unemployment Report will be released on Thursday, July 3. Job growth of 200,000 per month is not going to excite investors. We need to be north of 250,000.

Earnings season is a month away and early indications are good. FedEx and Adobe posted solid results last week. Intel raised its guidance and that pushed the entire semi-conductor group higher.

Expect tight daily trading ranges this week with a small upward bias. You should own a few calls and use SPY $195.60 as your stop.

I am day trading. I've been able to catch most of the intraday moves without taking overnight positions. I need to see proof that economic conditions are improving. Once I have that information, I will embrace this rally. The better-than-expected flash PMI in China was a step in the right direction.

Keep your size small.

.

.

Daily Bulletin Continues...