New Home Sales Were Better Than Expected – Look For A Slight Upward Bias This Week

Posted 10:20 AM ET - I scoured the overnight news and there is nothing material to report. Trading activity is very light and the path of least resistance is up. The next big news event is a week away and we can expect tight trading ranges the next few days.

New home sales were strong today and consumer sentiment was good.

The Fed did not introduce new tightening measures last week and traders rejoiced. Their forecast for GDP and employment was lowered, but the market didn't care. Tapering continues and rates are likely to rise.

Recent earnings have been decent (Federal Express and Adobe) and Micron posted good numbers yesterday. Intel raised its guidance last week and the tone is positive. Earnings season is still a few weeks away.

Flash PMI's were in line and China exceeded expectations. Their economic growth has stabilized and I believe that is the key to keeping this rally alive.

The Fourth of July falls on Friday and the market will be closed. That means all of the news will be compressed into a four-day session. Hopefully, that will result in some decent trading action.

In order for the market to move based on the Unemployment Report, we need to see a number below 150K or above 250K. I don't believe that is going to happen.

Look for sluggish numbers that are good enough to nudge the market higher.

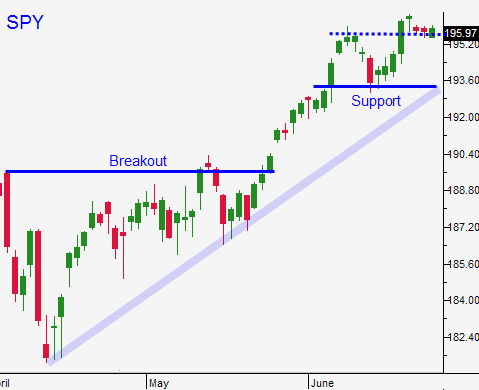

You should own a few calls. Use SPY $195.60 as your stop.

The market wants to inch higher today.

.

.

Daily Bulletin Continues...