Fed Tapers and Trims Econ Outlook. Plug Your Nose and Buy – Use Stops

Posted 9:30 AM - Market Open - Yesterday the Fed kept interest rates unchanged and they did not introduce new tightening measures. They said that economic conditions are tenuous and they lowered their growth forecast for the year to 2.8% from 3%. They also said that the jobless rate could rise to 6.3% from 6.1%.

The Fed continued their tapering and they reduced bond purchases by another $10B.

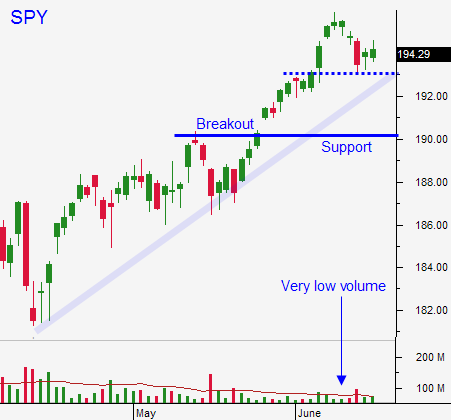

Stocks rallied on the news and the SPY closed at a new high. Once the momentum was established, quad witching goosed the market higher.

Interest rates will remain low because growth is sluggish. Money is flowing into equities due to a lack of attractive investment alternatives.

The Fed continues to taper. They know that QE has not simulated economic growth and that they need to remove the punch bowl at a steady pace. Their balance sheet is huge they have to unwind now. If they wait until conditions improve, they will cause a huge spike in interest rates.

The news was not good. This has been a “plug your nose and buy” rally. We have the breakout and you can buy some calls. Keep your size small and use SPY $195.60 (prior closing high) as your stop.

China’s IP and retail sales were good last week and the flash PMIs on Monday should be market friendly.

I will continue to day trade. I have been able to catch almost every move without the risk of overnight positions. I still do not trust this rally and I can’t embrace it until I have proof that economic conditions are improving.

Keep your size small and use stops.

.

.

Daily Bulletin Continues...