Higher Oil Prices Spark Profit Taking – Q1 GDP -2.9% – Much Worse Than Expected

Posted 10:00 AM ET - The Dow Jones was down more than 100 points yesterday and that was only the second decent down day in over a month. Tension in the Ukraine is escalating and the crisis in Iraq is growing. This morning, investors got another reason to take profits.

Q1 GDP (final revision) came in at -2.9%. That was much worse than expected. No one seems to care because the focus is on Q2. Analysts believe that growth will rebound and most are looking for a number north of 3%. Given the recent economic releases, I don't believe we will get there.

Last week, the Fed lowered their forecast for GDP in 2014. They could see the writing on the wall and that is why they did not introduce new tightening measures.

Last week, the Fed also projected a higher jobless rate. This might bode poorly for next week's numbers.

ISM manufacturing/services, ADP and the Unemployment Report will be released during a holiday shortened week. This compressed calendar should result in decent price movement.

Recent earnings (Adobe, Intel, FedEx and Micron) have been good. Alcoa will post on July 8th, but the major releases won't start until the middle of July.

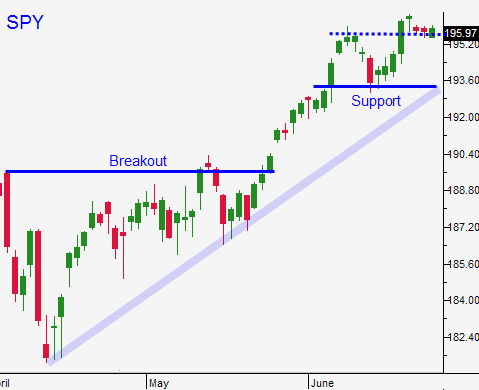

If we get a little follow-through selling today, bullish speculators could hit the panic button and the SPY could fall to $193. I don't see us challenging the breakout ($190), but that would set up a nice buying opportunity.

There are enough little negatives to spark a small round of selling (Ukraine, Iraq, GDP, durable goods orders, inflation and higher oil prices). These are not major threats to this rally and on a longer-term basis you should maintain a buy the dip mentality.

I am going to day trade from the short side today. I believe we will see another round of selling.

You should have exited your call positions yesterday when the SPY traded below $195.60. If you did that, you lock-in some nice profits.

Swing traders should wait on the sidelines. Let this wave of selling run its course and be prepared to get back in when support is established.

.

.

Daily Bulletin Continues...