Market Prepares For Major Econ Releases – Hope You Liked Last Month’s Numbers

Posted 9:15 AM ET - The market is right where it was three weeks ago. We are in the summer doldrums and I doubt that this week's heavy round of economic releases will break us out.

Tomorrow, ISM manufacturing and official PMI's will be released. Analysts are expecting ISM to come in at the same level we saw a month ago (55.4). Official PMI's should be in line since we just got the flash numbers last week.

Wednesday, ADP will be released. Analysts are calling for 200,000 new jobs in the private sector during the month of June. This is slightly better than last month’s number (179k).

On Thursday, the ECB will release its statement. They made some major moves during the last meeting and this month's comments should be benign.

The Unemployment Report and ISM services will be released on Thursday. Analysts are calling for a reading of 56.5 and for 213,000 new jobs. Those numbers match last month’s results.

If you like last month's numbers, you're going to love the releases this week.

In its last statement the Fed lowered its jobs forecast. This could bode poorly for Thursday's number. Any surprise favors the downside, but I don't believe we will see much of a reaction between 175,000 - 225,000.

Earnings season will begin next week and that is bullish. Recent releases (Adobe, FedEx, Intel and Micron) have been good. Major announcements are still a couple of weeks away and we could fall back into quiet trading next week.

Corporate profits were flat in Q1 and revenues barely kept pace with inflation. Stocks are trading at a forward P/E of 16 and good news is priced in. Option implied volatilities are at historic lows and confidence is high.

There are plenty of negatives to keep a lid on this rally (higher oil prices, tapering, sluggish global growth, flat revenues, pricey P/E’s and signs of inflation). However, we won't see a correction unless credit concerns surface. I don't think credit will be a major issue this summer, but Argentina is in technical default today.

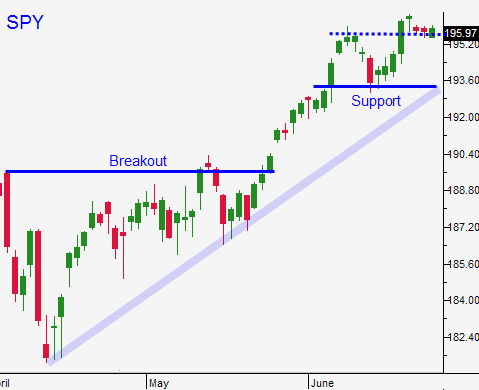

Wait for the news to play out this week. If the market closes above $195.60, buy a few calls and use that as your stop. If the market pulls back, wait for support and prepare to buy the dip.

Let's hope for some action this week.

.

.

Daily Bulletin Continues...