Let’s Hope For Some 4th of July Fireworks During A Short Trading Week

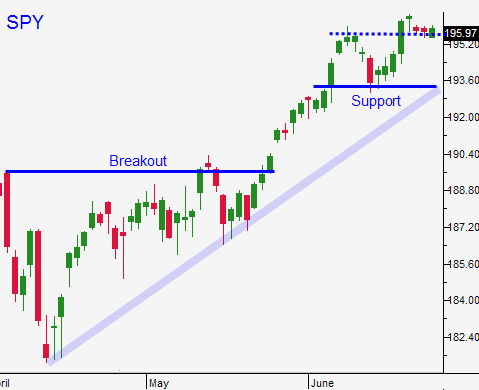

Posted 9:45 AM ET - This is a Teflon market. All bad news is discounted and the SPY is within striking distance of the all-time high.

This week, oil prices moved higher as the conflict in Iraq escalates. Q1 GDP missed by a wide margin (-2.9%) and durable goods orders declined. A non-voting Fed member made hawkish statements and an early suggested the Fed needs to tighten. The market was able to deflect all of these events.

Next week's trading activity will be compressed into four days because of the holiday. Major economic releases are scheduled (ISM manufacturing/ISM services, ADP and the Unemployment Report). We could see decent volume and nice price movement.

The Fed lowered its employment outlook and that might bode poorly for next week's jobs numbers. The street is looking for 200,000 new jobs in June. Personally, I feel this would be a dismal number. It is not consistent with the 3% GDP growth projection most analysts have for Q2. We need at least 300,000 new jobs just to keep pace with the labor force.

Retailers continue to post dismal results and the guidance is gloomy. Where is the pent-up demand?

Earnings season will start when we come back from holiday and that is typically bullish for the market. Recent reports (Adobe, Intel, FedEx and Micron) were good and that should keep a bid under the market.

Corporate profits were flat in Q1 and revenues barely kept pace with inflation. At a forward P/E of 16, there is room for a correction.

The Fed has an enormous balance sheet and they know they are painted into a corner. QE has not stimulated economic growth and they are progressively reducing bond purchases. Inflation is creeping into the economy and interest rates will start moving higher in September.

To this point, central banks have provided a safety net. Interest rates are near historic lows and money has been dripping into equities due to a lack of investment alternatives. As this safety net is removed, risk will increase.

There is very little fear in the marketplace. Option implied volatilities are near historic lows. In my 25 years, I recognize this as a correction friendly environment. I am not calling for a top, but I am on high alert. In order for us to see a decline of more than 10%, credit concerns need to surface.

The market has not gone anywhere in the last two weeks and I can't justify taking a position ahead of major economic releases. We took some nice profits on call positions earlier in the week when the SPY breached $195.60.

Let's hope for some action next week.

.

.

Daily Bulletin Continues...