Official PMI’s Better Than Expected – Market Poised To Challenge the High Today

Posted 9:15 AM ET - The market started the week off on a quiet note. Traders are waiting for major economic releases and we traded in a very tight range on Monday.

Official PMI's were released this morning and they were slightly better-than-expected. Stocks are rallying before the open and we could challenge the all-time high today.

ISM Manufacturing will be released 30 minutes after the open. Chicago PMI was better than expected yesterday and that bodes well for this number.

ADP will be released tomorrow. Analysts are expecting 200,000 new jobs in the private sector during the month of June. That is slightly better than last month's reading. A number between 175,000 and 225,000 probably won't generate much of a reaction.

ISM Services and the Unemployment Report will be posted on Thursday. Analysts are expecting both numbers to match the results from last month.

From my perspective, these numbers are good enough to tread water, but they do not justify a rally. Global growth is sluggish and we are not seeing signs of pent-up demand in the US. Europe will grow 1% this year and the Fed lowered projections (2.8%) for the US. After the 2.9% decline in Q1, I doubt 2014 GDP will reach their target.

Corporate profits were flat and revenues barely kept pace with inflation. At a forward P/E of 16.5, good news is priced in.

Central banks continue to print money and consequently yields are at historic lows. Money is dripping into equities due to a lack of attractive investment alternatives.

The current mentality can be described as "plug your nose and buy". Option implied volatilities are at historic lows and confidence is high.

Stocks will float higher until credit concerns surface. Credit risks should be subdued this summer.

Even if the economic releases are soft this week, the market could grind higher on the notion that the Fed will postpone tapering.

Earnings season begins next week and that has a bullish influence on the market. The market has also been rallying into the jobs report the last 4 months.

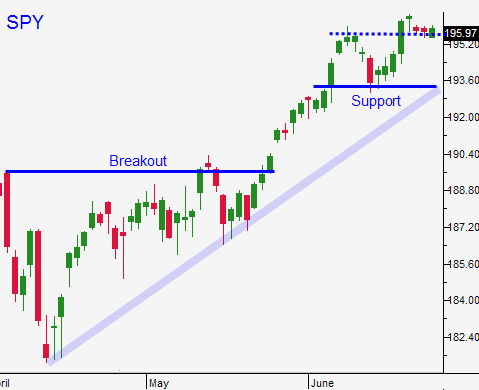

Aggressive accounts can buy a few calls - use SPY $195.60 as a stop.

.

.

Daily Bulletin Continues...