If the Early Rally Holds – Buy Calls. Any Dip Will Be Brief and Shallow

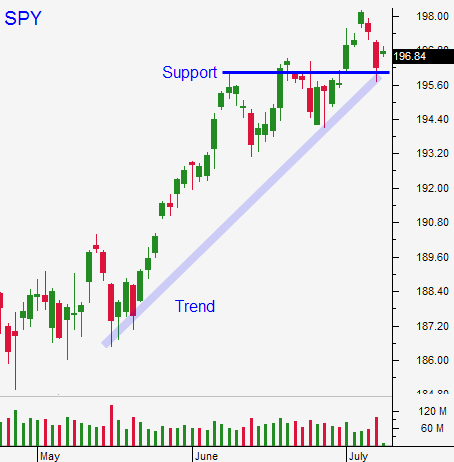

Posted 9:45 AM ET - Yesterday the market drifted down to the support level I outlined (SPY $196) and it bounced. This light wave of selling should run its course in a few days and I believe it will set up a nice buying opportunity.

The economic data in the last week was strong. Multiple sources confirm the trend in job growth. Asset Managers have the data they need and the bid will grow when they don't get the pullback they were hoping for. Volumes have been light and they have not participated in the rally. That means that any dip will be brief and shallow.

Alcoa kicked off earnings season and they beat estimates. Rolled aluminum sales were up 20% and cyclical stocks will rally on the news. Wells Fargo will post results on Friday. Bank profits are expected to be soft this quarter and bad news is priced in. The initial reaction might be muted, but the financial sector will catch a bid. Interest rates will start moving higher and that is good for profits.

China will post its trade numbers tonight. Fiscal spending is bearing fruit and their economic growth is stable. I believe China is a key component to this rally.

The FOMC minutes will be released this afternoon. The Fed did not introduce alternative tightening measures last month and they cited weakness (lower GDP forecast and lower employment). I believe the minutes will be rather dovish and that should be good for the market this afternoon.

Bond vigilantes are worried that strong economic data will force the Fed to tighten sooner than expected. Interest rates have not spiked and even if they did, the market should be able to shoulder higher yields as long as the economic recovery is on track.

The strongest companies announce early in the earning cycle and optimism builds.

Asset Managers will be playing catch-up and you should buy some calls this week.

I own some calls from last week and if today's rally holds up early in the day, I will buy more.

Use SPY $196 as your stop.

.

.

Daily Bulletin Continues...